Michigan Mortgage Rates

Home Loan Interest Rates

Mortgage rates are near historic lows however the Federal Reserve has been clear about their intentions to raise their rates in the near future. As the economy slowly starts to recover with lower unemployment and higher inflation, mortgage rates nationwide will slowly adjust upward. If you are interested in buying a home or refinancing your current mortgage, now is the time to act!

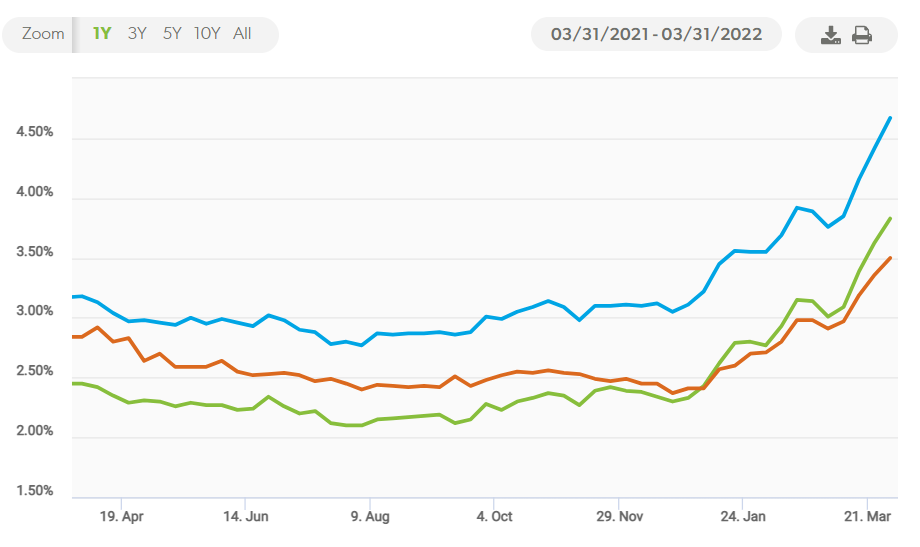

Michigan Mortgage Rate Chart

Mortgage rates in Michigan change daily. See below for an estimated range to expect for Michigan home loans.

Current Mortgage Rates in Michigan:

NOTICE: Interest rates shown for example purposes only using industry averages and not specifically Riverbank Finance LLC's available rates. Mortgage Rates may change without notice. Not all will qualify. Please contact your loan officer for a complete loan estimate with rates and Annual Percentage Rate for your situation.

Primary Mortgage Rate Market Survey (US Weekly Averages)

Interest rate chart data from Freddie Mac mortgage rates based on US weekly average survey.

MORTGAGE RATE EXAMPLE:

Home Buyer A) get a $200,000 home loan at 6%. Home Buyer B) also buys a home with a $200,000 mortgage but locks in an interest rate at 4.50%.

Home Buyer B) would save an estimated $185.73 per month compared to Home Buyer A) with these example rates.

That is equivalent to saving $2,228.76 per year. Over the life of a 30 year mortgage, this would be a significant amount equalling $66,862.80 in interest savings (if compared at a fully amortized loan term).

**Above rates are for illustration purposes only. Current mortgage rates may be lower or higher depending on market conditions, loan term, borrower credit scores, mortgage programs and other factors. Please check with your loan officer for an exact rate quote by calling 1-800-555-2098.

By clicking "Submit", you consent to receive calls and texts at the number you provided, including marketing by autodialer and prerecorded and artificial voice, and email, from Riverbank Finance LLC about your inquiry and other home-related matters, but not as a condition of any purchase; this applies regardless of whether you check, or leave un-checked, any box above. You also agree to our Privacy Policy and Terms of Use regarding the information relating to you. Msg/data rates may apply. This consent applies even if you are on a corporate, state or national Do Not Call list. This no obligation inquiry does not constitute a mortgage application. To apply now or get immediate assistance, call us at 1-800-555-2098.

What are the current rates in Michigan?

There are several factors that will determine your mortgage rate including, credit, loan-to-value, loan program and other factors. Mortgage rates in Grand Rapids are the near lowest we have seen in history.

If you are over 4.99% then now is the time to take advantage of the current refinance rates. If you are considering purchasing a home, then you can get more for your money with interest rates low and home prices at their rock bottom!

Factors that determine Mortgage Rates Include:

- Credit Score

- Loan to Value Ratio (LTV)

- Property Type (Single Family Residence vs Condo)

- Loan Type (Conventional vs FHA)

- Including Escrows in your payment vs Waiving Escrow

How to get the lowest interest rates - Tips and Advice

If you are hoping to reduce your mortgage payments by refinancing your home loan or if you are planning on purchasing a home in the near future then I strongly recommend you lock in your mortgage rate while they are still near historic lows. Home loan interest rates may rise at any time so request a lock as soon as possible.

What is the Best Mortgage?

| Loan Type | Interest Rate | Unique Benefits | Mortgage Insurance | Best For |

|---|---|---|---|---|

| 30-year fixed | Fixed rate for the life of a loan | Lox fixed payments | PMI is required if down payment is < 20% | Best for those who want a low monthly payment |

| 15-year fixed | Fixed rate for the life of a loan | Lower interest rate & less interest paid than a 30-year loan | PMI is required if down payment is < 20% | Best for those who want to pay off their loan quickly & save on interest |

| 5/1 ARM | Fixed rate for 5 years, then adjust once per year thereafter | Rates may be lower to start than a 30-year fixed | PMI typically required if down payment is < 20% | Best for those who will sell or refinance before 5 years |

| 7/1 ARM | Fixed rate for 7 years, then adjust once per year thereafter | Rates may be lower to start than a 30-year fixed | PMI typically required if down payment is < 20% | Best for those who will sell or refinance before 7 years |

| VA Loan | Can be fixed or adjustable | $0 down mortgage, no PMI, low interest rates | No PMI but a VA funding fee may be required | Qualifying Military Veterans or active service members |

| FHA Loan | Can be fixed or adjustable | Down payments as little as 3.5% and flexible credit score requirements | Upfront and monthly MIP is required | Best for those with a lower credit score or down payment |

| Jumbo Loan | Can be fixed or adjustable | Loan amounts that exceed the conforming loan limits | PMI is typically not required | Best for those that will need to borrow more than $726,200 |

How do I get the lowest mortgage rates in Michigan?

Getting the lowest interest rates on your mortgage in Michigan is important to save money over the life of your loan. A difference of even a half percentage point can cost you thousands of dollars over the years.

To ensure you get the lowest mortgage rates in Michigan be sure to check with a local mortgage company or mortgage broker. A mortgage broker can often times offer lower interest rates than the big banks because they have lower overhead and less costs in doing business. Additionally they may be able to structure your mortgage loan in a way that you get rock bottom rates.

After you find the right company for your home loan, you should consider other factors that determine your rate. Bank and lenders set their rates based on risk. The more risky the investment for the bank, the higher the interest rate they need to charge.

To get the best rates you will need a 25%+ down payment, 780 credit scores (or higher), conventional financing and a short mortgage term. For example, a 10 year mortgage will offer lower rates than a 30 year fixed mortgage. This is because there is less risk for the lender because they will get their investment back quickly.

5 tips to get a low mortgage Rate

- Improve your credit score by paying bills on time, reducing outstanding debt, and limiting new credit applications.

- Make a larger down payment, as it reduces the amount of money you need to borrow.

- Shop around for rates and compare rates from multiple lenders.

- Consider a shorter loan term, such as a 15-year mortgage, can result in a lower interest rate than a longer term, such as a 30-year mortgage.

- Look into government-insured loan programs, such as those backed by the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA), which can have lower mortgage rates than conventional loans.

If you are looking to lock in a low mortgage rate then call Riverbank Finance today at 1-800-555-2098 or request information on mortgage rates below.