Be sure to investigate property taxes before you buy a home. Sure, the real estate listing may estimate the current property taxes but you need to take it a step further to get the full tax costs. One common tax number that is overlooked is the SEV or State Equalized Value. Property taxes are based on the real estate’s current Taxable Value however the SEV is an important factor to determine future taxes once a property is transferred to a new owner.

Be sure to investigate property taxes before you buy a home. Sure, the real estate listing may estimate the current property taxes but you need to take it a step further to get the full tax costs. One common tax number that is overlooked is the SEV or State Equalized Value. Property taxes are based on the real estate’s current Taxable Value however the SEV is an important factor to determine future taxes once a property is transferred to a new owner.

What is the difference between SEV and Taxable Value?

The purpose of the SEV is a tax assessor’s way of giving their opinion of the true assessed value or market value of the home. The assessor’s opinion of market value is double the SEV. Be sure to note that this number may be way off from what a house could actually sell for and should not be relied on for market valuation purposes. The taxable value can be a different number to ensure that taxes do not jump significantly for homeowners that have owned a home for a long period of time.

Related: Michigan Property Transfer Tax Calculator

How Much can Property Taxes Rise Each Year?

Michigan property taxes were updated in 1994 when “Proposal A” was passed to reform real estate taxes. The premise of this law was to limit the increasing of taxes from year to year to a more predictable number. These caps are placed on the taxable value at 5% or the Consumer Price Index (CPI) rate of inflation, whichever is lower. The multiplier number is set by the Michigan State Tax Commission which has adopted the CPI which has maintained roughly 1% annually. This means that the taxable value cannot increase more than the cap each year and the Taxable Value will never be more than the SEV.

Once a property is sold the taxable value resets back to the SEV which has no cap. This is called “uncapping” a property’s taxable value. This process can cause a significant tax increase on the following year after buying a home. If your budget is based off the current taxes and you find yourself owing thousands more annually, you could be in a sticky financial situation.

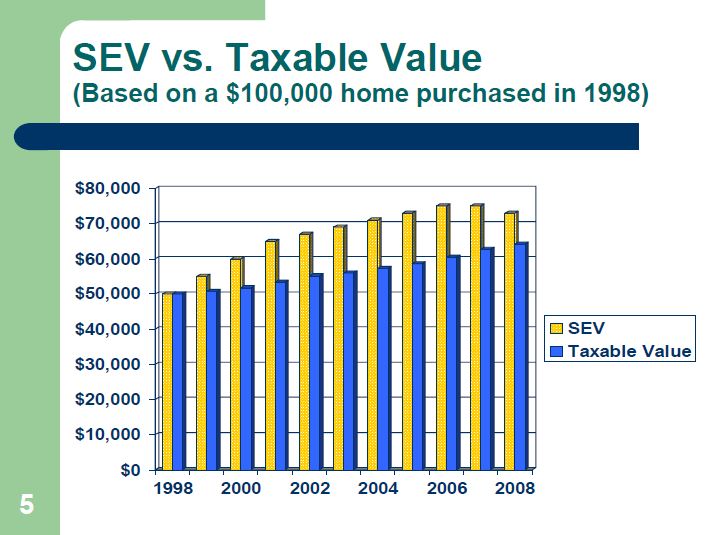

Below is an informational chart comparing SEV with taxable value in Michigan. Since 1999 most properties have a significantly higher SEV than taxable value. This is the difference taxes would change when it resets at the time of sale.

Here is an example of how to calculate property taxes in Michigan:

EXAMPLE: An elderly couple has lived in a home for many years and has decided to downsize to a condo for easier maintenance. Their Taxable Value is currently at $120,000 and their SEV is currently at $150,000. The millage rate for their area is a total of 38.000 mills.

Here is the math to calculate their current property tax:

(Mills/1000) x Taxable Value = Property Taxes Due

(38.000/1000) x $120,000 = $4,560

Once the property is transferred to the new owner and the taxable value is uncapped and reset to the SEV.

Here is the math to calculate future estimated taxes:

(Mills/1000) x State Equalized Value = Future Property Taxes Due

(38.000/1000) x $150,000 = $5,700

In this example, the homebuyers would see their taxes go up $1140 annually or nearly $100 per month. If this is not accounted for in the homebuyer’s budget this could lead to huge payment shock.

For Current Michigan Property Tax information Visit: http://www.michigan.gov/taxes/0,4676,7-238-43535—,00.html

NOTE: This tool is intended to be used for illustrative purposes only. Estimates are not guaranteed and may be different based on your individual situation. Riverbank Finance LLC does not provide tax or legal advice. It is recommended that you consult with a tax attorney for advice on your situation.

800-555-2098

800-555-2098