On May 1st, 2024 the FHFA announced the First-Generation Homebuyer Loan program. This is a home loan targeted at homebuyers whose parents have not owned real estate. Those who qualify under this loan may receive discounted mortgage rates, down payment assistance or help with closing costs.

This new program is part of their Final Rule which is an update to the 2022 Equitable Housing Finance Plan. The Equitable Housing Finance Plan is a three-year strategy aimed at addressing disparities in the U.S. housing market. This loan is designed for individuals whose parents have not owned a property. It aligns with the government’s commitment to fairness and accessibility in housing.

Unlike traditional homebuyers, first-generation buyers often lack the financial support of parents for down payments and upfront costs. This initiative aims to bridge the gap in generational wealth created by homeownership, ultimately working to reduce nationwide wealth disparities.

Expanding the Eligibility of Affordability Housing Products to Include First-Generation Homebuyers

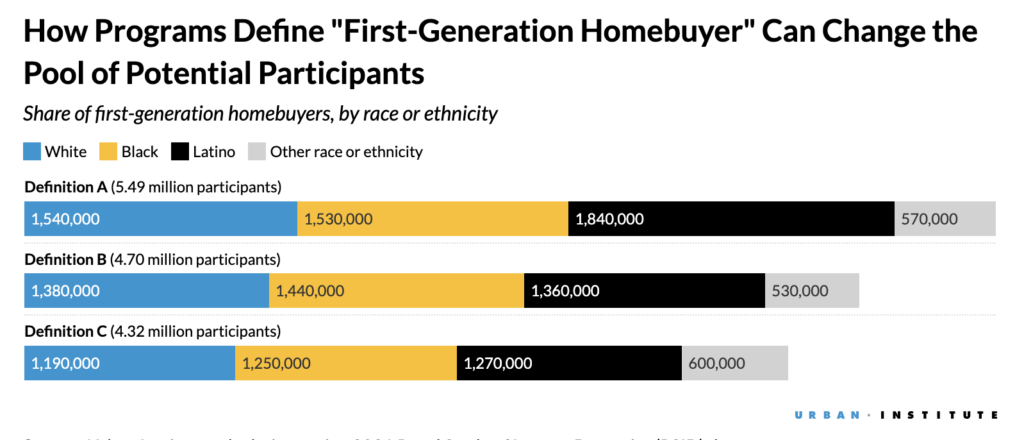

Expanding the eligibility requirements of the HomeReady and Home Possible programs to include first-generation households with incomes up to and including 120% of area median income will permit an additional 1.2 million households, the majority of whom are either Black or Latino, to make use of these programs assuming they met the other eligibility criteria.

First-Generation Homebuyer Loan Requirements:

A first-generation homebuyer loan is one in which each borrower meets the following requirements:

- Is purchasing the subject property,

- Will reside in the subject property as a principal residence,

- Has had no ownership interest (sole or joint) in another property during the last three years preceding the note date of the loan, and

- One of the following must also apply:

- No parent of the borrower has had an ownership interest (sole or joint) in a property in the last three years preceding the note date of the loan,

- The borrower has aged out of foster care, or

- The borrower has been emancipated.

How Do I Qualify for the First-Generation Homebuyer Loan?

A buyer must be eligible for conventional mortgage guidelines. After applying for a mortgage, your loan officer will help to review income, credit and assets to confirm pre-approval. Once a contract is received to buy a home, the mortgage underwriter will review documentation to confirm approval.

Required Documentation for Financing:

- Paystubs

- W2 Statements

- Bank Statements

- Retirement Account Statements

- Photo ID / Drivers License

- Social Security Card

If a buyer is eligible for conventional financing, the lender must help prepare a First-Generation Homebuyer Certification for loan eligibility.

Apply for the First-Generation Homebuyer Loan

Complete the form below to request information on the First-Generation Homebuyer Loan or call us at 800-555-2098 to speak with a loan officer.

What Down Payment Assistance Programs are available for First Time Homebuyers?

We offer several down payment assistance programs to help families buy homes with little or no money for a down payment. Here are a couple of options that may be a good fit!

Conventional 1% Down Mortgage: In this program, you can purchase a home with 3% equity, but only 1% down payment. The Lender applies a down payment assistance grant of up to 2% of the purchase price at closing.

FHA Down Payment Assistance Mortgage: With this loan option a homebuyer may receive down payment assistance of 2% or 3.5% to pay for the down payment to buy a home. With this loan option a homebuyer may also take advantage of seller paid closing costs to buy a home with little or no money down.

Frequently Asked Questions

The following information provides answers to questions frequently asked about our jointly developed first-generation homebuyer mortgage definition.

Q1. If only one borrower on the mortgage application meets the first-generation homebuyer requirements, is the mortgage considered a first-generation homebuyer mortgage?

A1. No, all borrowers must meet the first-generation homebuyer requirements for the mortgage to be considered a first-generation homebuyer mortgage.

Q2. How does a borrower certify their status for a mortgage to be considered a first-generation homebuyer mortgage?

A2. All borrowers on the mortgage must complete and sign Form 1109, First-Generation Homebuyer Certification, to attest to their status. The lender must keep the executed form(s) in the mortgage file.

Q3. The certification provides only for two borrowers. What if there are more than two borrowers on the mortgage application?

A3. The lender should provide the borrowers with additional copies of the certification, as needed. All borrowers must complete and sign the certification for the mortgage to be considered a first-generation homebuyer mortgage.

Q4. Who is considered a parent?

A4. We consider a parent to be a biological or a legally adoptive parent.

Q5. Why doesn’t the GSE definition of a first-generation homebuyer mortgage reference borrower’s legal guardian in addition to parent?

A5. We recognize that other first-generation homebuyer definitions consider prior property ownership of a legal guardian; however, the GSEs concluded that individuals under a legal guardianship (or previously under a legal guardianship) are less likely to have access to the guardian’s intergenerational wealth. Additionally, we want to minimize the potential confusion for borrowers that no longer have a legal guardian but may have previously had one. Therefore, the GSEs are not requiring a legal guardian’s property ownership status or history to be considered.

Q6. Would a borrower qualify as a first-generation homebuyer if the borrower or the parent has ownership rights in a property, but the property is heirs’ property (i.e., the borrower or the parent has joint ownership with other descendants of a deceased individual whose estate did not clear probate)?

A6. The borrower could still meet the requirements of first-generation homebuyer, provided that all other requirements are met. This is also notated on the First-Generation Homebuyer Certification for the borrower.

Q7. What does ownership interest in a property include or not include?

A7. As indicated in the certification form (Form 1109), ownership interest in a property includes real property owned in or outside of the United States. It does not include heir’s property, undeveloped land, a manufactured home or mobile home titled as personal property or a contract for deed. The lender can rely on the borrower’s completion of the Uniform Residential Loan Application, Section 5 Declaration, 5a., which presumes ownership in another property is residential in nature based on the response to question 5.a (1), primary residence, FHA secondary residence, second home or investment property.

Q8. Why does the certification require the borrower to provide the name and address of their parents?

A8. By requiring this information, the GSEs aim at addressing possible misrepresentation without overburdening the borrowers. Furthermore, this information will lay the groundwork for verification of first-generation status in the future if first-generation mortgage offerings are introduced.

Q9. Is the lender required to verify the parent’s property ownership status or address information on the certification?

A9. No, there is no requirement for the lender to verify the parent’s information provided by the borrower on the certification.

Q10. Is the lender responsible for representations and warranties related to the delivery of the IFI for a first-generation homebuyer mortgage?

A10. When delivering the IFI for a first-generation homebuyer mortgage, the lender is representing and warranting that all borrowers have completed the certification, and the certification(s) is in the mortgage file.

Q11. There are programs in the market that have different criteria for defining a first-generation homebuyer mortgage. If a lender originates a mortgage that meets a different definition and sells that mortgage to Freddie Mac under their standard Guide requirements, is the IFI still required?

A11. If the mortgage was originated under a program with different criteria for a first-generation homebuyer mortgage, the lender should only deliver the IFI if the mortgage also meets the GSE definition of a first-generation homebuyer mortgage, and the lender has the completed certifications for all borrowers in the mortgage file.

Q12. Why are the GSEs publishing this definition and requesting an IFI if the definition is not being used for mortgage eligibility, pricing or MBS disclosures?

A12. We believe we can help establish an industry standard by publishing an aligned definition. It also gives us the opportunity to understand adoption and any implementation challenges for the industry before we apply it to any products or use cases.

Is there Down Payment Assistance available for me to buy a home?

In addition to a focus on first generation homebuyers, Freddie Mac has created new loan tools to help identify Down Payment Assistance programs. DPA One is designed to help quickly find, understand, and match down payment assistance (DPA) programs for borrowers.

Additional Resources

800-555-2098

800-555-2098