Second home loan rates are on their way up as the Feds battle high inflation and home affordability. Vacation home purchases have increased at a record pace during the COVID stay-at-home pandemic. Families are looking for safe getaways and investors are buying vacation homes to rent on AIRBNB or VRBO.

Fannie Mae has announce that they will be raising rates on second home loans. Industry experts believe that this move is to reduce the competition for primary residence home buyers. The new adjustments will affect all loans they purchase after April 1st, 2022. Theses rate hikes come in the form of loan level price adjustments that lender must apply to vacation home loans.

We periodically reassess our pricing as it relates to specific products and current market conditions. Under the guidance of FHFA, and in coordination with Freddie Mac, we are revising our pricing for second home and high-balance loans.

Fannie Mae Lender Letter 2022-01

Can I still get a Second Home Loan at a Low Rate?

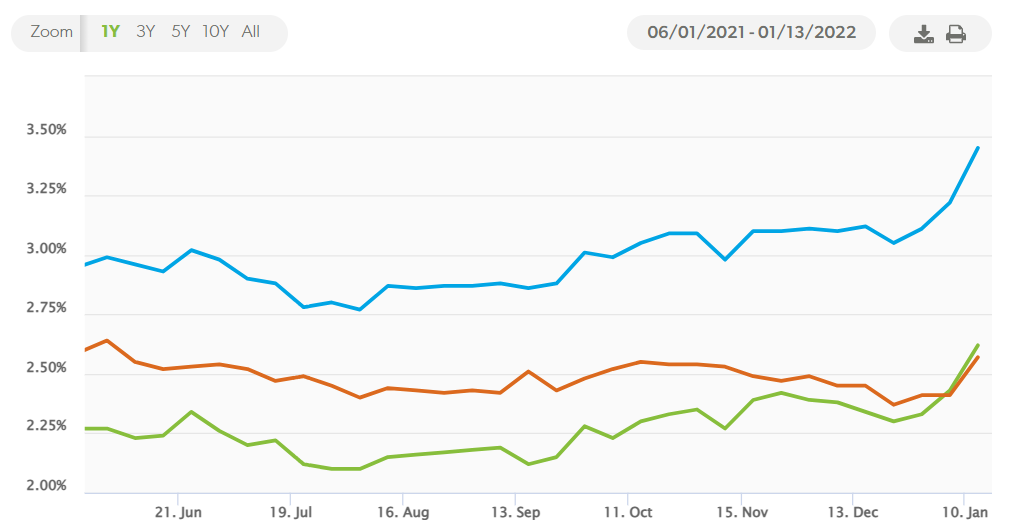

There has been upward pressure on mortgage rates with the Federal Reserve fighting higher than expected inflation. To battle inflation pressures, they have announced plans to taper bond purchases and confirmed that they will raise the Federal Reserve Rates. The Fed Rates are the rates at which banks can borrower money from the government. Higher Fed Rates indirectly increase mortgage lending rates.

With rates moving up and the new LLPAs added, rates are on their way up for to second home loans. With these points in consideration, mortgage rates are still near historic lows. Vacation home buyers can still buy a great home at low rates.

Why are Second Home Loan Rates Going Up?

The Biden Administration has a large focus on affordable housing for the underprivileged. The new changes are taking action to promote homeownership.

Second homes and Vacation homes are increasingly becoming more competition for first time home buyers. Rate hikes will make second home purchases less attractive for AIRBNB or Vacation Rental By Owner (VBRO) buyers. This levels the playing field for buyers seeking homes as their primary residences.

What are Loan Level Pricing Adjustments on Second Homes?

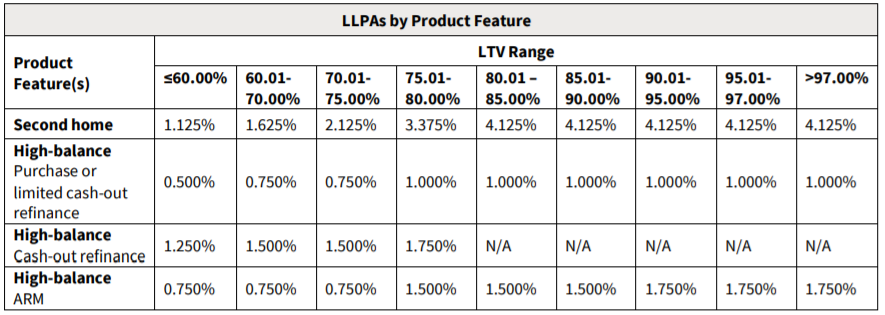

LLPAs, or Loan Level Price Adjustments, are adjustments to mortgage pricing when loans are sold to Fannie Mae or Freddie Mac. Lenders are forced to pass on these rates adjustments to borrowers when seeing mortgages.

Second Home Loan Rate Pricing Adjustments

The adjustments shown in the table above affect the pricing of the mortgage rates. They do not set the mortgage rates directly. In the chart below second homes had a LLPA added of 4.125% for the standard 20% down second home purchase.

For example if a borrower is buying a home for $400,000 with a 20% down payment, their loan amount would be $320,000. The LLPA would equate to an additional fee of $13,200. Instead of paying this large fee up front for LLPAs, lenders adjust the rates upward to help reduce these costs.

When Will Second Home Loan Rates Go Up?

Fannie Mae Announced the mortgage rate increase for all loans sold to them starting April 1st, 2022. Most loans take 30-45 days to close. In addition to the loan processing time, it takes up to another 15 days to package the loan documents and have it available and ready to sell. Due to these timelines, many lenders have started implementing this pricing adjustment for all new loan effective immediately.

What are Second Home Mortgage Rates Currently?

Mortgage rates changes daily and will depend on a borrowers credit score, loan amount, down payment and property type. Since each borrower’s loan is different, the only way to get a quote is to call a mortgage broker such as Riverbank Finance. A loan officer will be able to price out loan options for your situation and offer you the best loan programs for your goals.

800-555-2098

800-555-2098