Refinance Your Home Without an Appraisal

Soon, homeowners will be able to refinance their homes without an appraisal! Beginning December 10th 2016, Fannie Mae will offer an Enhanced Property Inspection Waiver (PIW) for ONE-IN-FOUR transactions.

What is a Property Inspection Waiver?

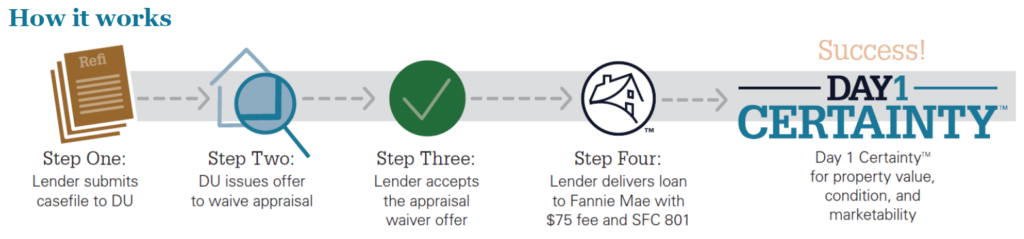

A Property Inspection Waiver is Fannie Mae’s offer to waive the requirement for an appraisal on certain refinance transactions. It is unclear at this time whether or not purchase transactions will be offered a PIW, but more information will be released as the launch date approaches.

“When a DU loan casefile receives a PIW offer and it is exercised by the lender, Fannie Mae accepts the value estimate submitted by the lender as the market value for the subject property.” -Fannie Mae

To exercise a PIW offer, the lender must provide a Special Feature Code and the borrower must pay a $75 fee at time of loan delivery to Fannie Mae. This $75 PIW fee provides a desirable alternative to traditional appraisals, which carry an out-of-pocket cost of $400-$600 to the borrower.

Related: Refinance your FHA mortgage without an appraisal

What is the Benefit of a Property Inspection Waiver?

The Enhanced PIW provides many benefits to both the lender and the consumer, such as:

- Provides a lower-cost alternative to a traditional appraisal

- Shortens the loan origination process by removing the need to review an appraisal

- Eliminates the expense of appraisal-related delays

Who Will Receive a Property Inspection Waiver?

Fannie Mae will use proprietary analytics and a large database of appraisal reports to determine the minimum property value for new loans. Not all transactions will receive a PIW offer—some will still require an appraisal to determine market value.

“PIW offers are issued through Desktop Underwriter® using Fannie Mae’s database of more than 20 million appraisal reports in combination with proprietary analytics from Collateral Underwriter® to determine the minimum level of property valuation required for loans delivered to us.” -Fannie Mae

What Transactions Are Eligible for a Property Inspection Waiver?

- Single-Family Properties and Condominiums

- Principal Residence, Second Home, and Investment Properties

- Limited Cash-out Refinances up to 90% LTV (principal residences)

- Cash-out Refinances up to 70% LTV (principal residences)

- Approve/Eligible Casefiles

Have a specific scenario you’d like to run past us? Give us a call to speak with one of our licensed loan officers. We would love to recommend the best loan program for you and your situation.

Get More Information

To apply for a Renovation Mortgage or Refinance call Riverbank Finance today at 1-800-555-2098.

800-555-2098

800-555-2098