The Federal Housing Finance Agency (FHFA) announced increased loan limits for the 2019 calendar year for Conventional Home Loans. The maximum conforming loan limits for mortgages to be acquired by Fannie Mae and Freddie Mac in 2019 will be effective for all loans sold on or after January 1st, 2019. In most of the U.S.,… Read more »

Michigan VA Home Loans

VA Loans are mortgages guaranteed by the US Government for military members who have served our country. With no down payment required, VA Loans are one of the best loan options. Underwriting requirements are flexible which allows for low credit scores and short wait periods after bankruptcy and foreclosure. We currently offer Zero Down VA… Read more »

How to get the Best Mortgage Loan

When it comes to home loans, there are hundreds of loan programs and options that you may want to consider. Many first time home buyers do not know where to start when they want to buy a home. It is overwhelming to most people who do not have experience buying a home or getting a… Read more »

Doctor Home Loans In Michigan

Are you currently in, or recently completed a medical residency or fellowship? Our Doctors’ Loans exclude student loans from your debt-to-income ratio! Call us today at 800-555-2098 and let us discuss your options! Benefits of Doctors Loans in Michigan Doctors can now easily qualify for a mortgage without including student loans in the debt to… Read more »

8 Tips for Moving with Pets

The Top 10 Largest Employers in Grand Rapids, Michigan

List of Top Employers in Grand Rapids, MI Combined, the top 10 largest employers in Grand Rapids employ over 66,000 people. These companies are involved in various industries which include healthcare, grocery, shopping, consumer goods, manufacturing, technology, automotive, education, and furniture. In fact, Grand Rapids is known by many as “Furniture City” because it is… Read more »

Free Conventional Appraisals

We have some exciting news! Conventional Appraisals are now FREE for new loans submitted to us from 08/26/2018 that close by 12/31/2018! Free Conventional Purchase Loan Appraisals If you are buying a home, then take advantage of the our Free Appraisal program to keep up to an extra $525 in your pocket when we take… Read more »

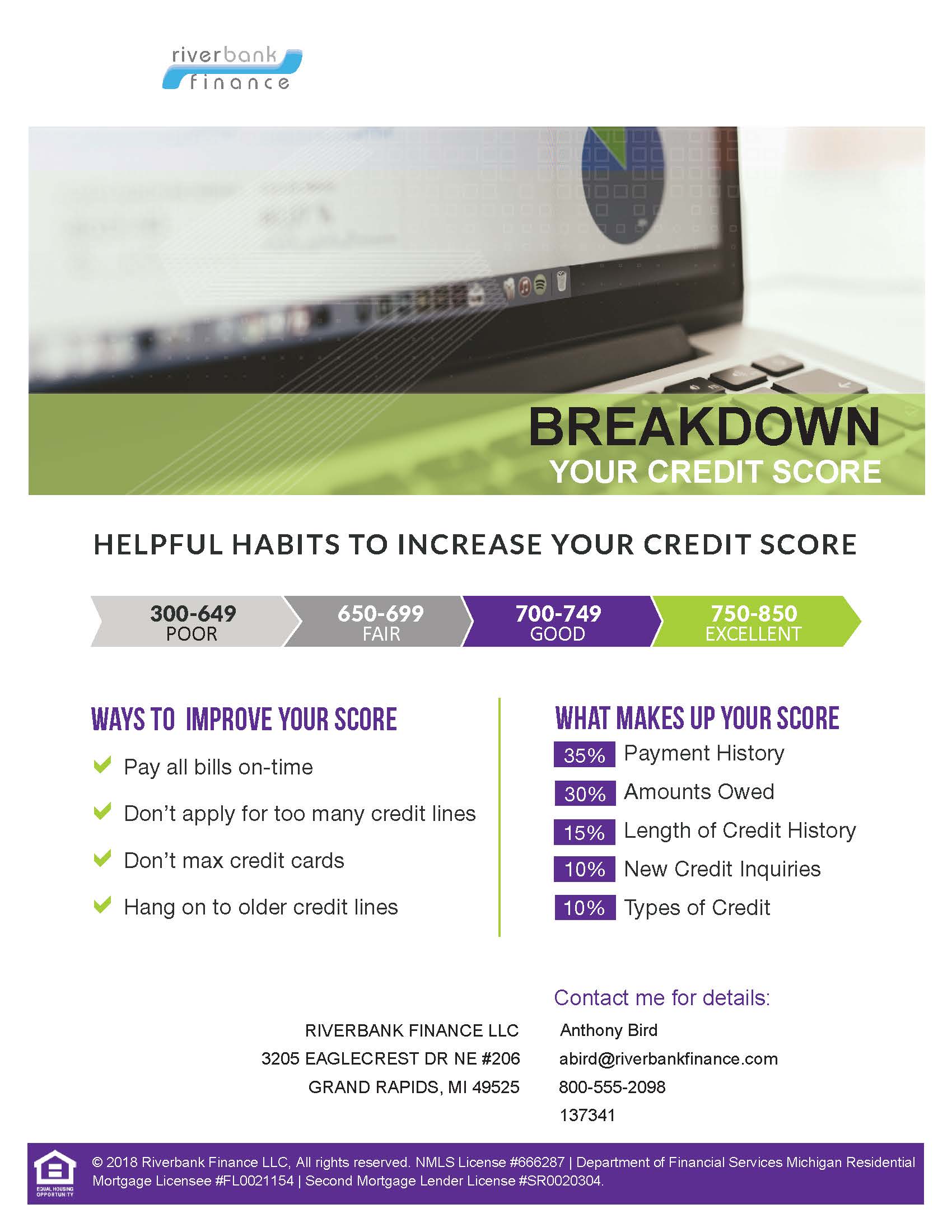

Breakdown Your Credit Score

When buying a home, your credit score is an important factor in your home loan approval. It is important to know what is on your credit and what credit score you have when applying for a mortgage. While, the exact scoring models are proprietary and not released by the credit bureaus to the public, credit… Read more »

800-555-2098

800-555-2098