Are you a business owner in Michigan and wondering how to navigate mortgage for self-employed individuals? You’re not alone! Nearly 15% of U.S. homeowners are self-employed, and many hit roadblocks when lenders ask for traditional pay stubs.

In this guide, we’ll walk you through everything from qualifying criteria to documentation tips, financial preparation with tips and tricks so you can confidently apply for a home loan. You’ll know exactly what lenders look for, how to present your income, and which loan programs play best for freelancers, contractors, and small-business owners in the Great Lakes State.

Understanding Self-Employed Mortgage Challenges in Michigan

Self-employed borrowers get the side-eye from lenders. It’s not personal… it’s just business.

When you work for yourself, your income looks like a roller coaster to lenders. One month you’re crushing it, the next you’re eating ramen. Traditional W-2 employees show up with neat little pay stubs that make lenders smile. You? You’ve got spreadsheets and tax returns that tell a more complex story.

Lenders lose sleep over two things: will you keep making money, and will you pay them back? Your income bounces around more than a kid on a trampoline, which makes them nervous.

Michigan’s housing market in 2025 is… interesting. Home prices have stabilized after the post-pandemic chaos, but inventory remains tight in hot spots like Grand Rapids and Ann Arbor. Detroit’s comeback story continues, with neighborhoods seeing real investment. Rural areas offer incredible value if you can work remotely.

The state’s economy affects your mortgage approval more than you might think. Michigan’s diverse industrial base – from automotive to agriculture to tech – means lenders understand seasonal businesses better here than in other states. A maple syrup producer or Christmas tree farmer won’t shock a Michigan underwriter.

Eligibility Requirements: What Lenders Look For with Mortgages for Self-Employed

Credit scores matter when it comes to mortgages for self-employed. Most lenders want to see 620 minimum for conventional loans, though 640+ (and higher) gives you better rates and terms. FHA loans will work with 580, but you may pay higher mortgage insurance premiums. Your credit history needs to show responsibility, not perfection. A few late payments won’t kill your chances if everything else looks solid.

Debt-to-income ratios get trickier when you’re self-employed. Lenders typically want your total monthly debts (including the new mortgage) to stay under 43% of your monthly income (sometimes we can get by with up to a 50% DTI). But here’s the catch – they use your adjusted gross income from tax returns, not your gross business revenue.

Your business needs some gray hair on it. Most lenders want two years of tax returns showing business income, however we have some NON-QM mortgage options with only 1 years self-employed. Brand new entrepreneurs face an uphill battle, though some portfolio lenders will work with one year of strong financials.

Michigan doesn’t require special licensing for most self-employed folks, but if your business needs state registration or professional licenses, have that paperwork ready. As part of the application process, your loan officer and mortgage processors will confirm the business formation date using Michigan Business Entity Search. This public website will show the company start date to confirm it meets minimum requirements.

Required Documentation and Income Verification for Mortgages for Self-Employed

Tax returns are your mortgage application’s main character. Lenders dig deep into those Schedule C forms, looking at your net profit trends. They’re not just checking if you made money – they want to see stability or growth.

Here’s where it gets frustrating. Remember all those legitimate business deductions that saved you taxes? They now work against you. That home office deduction, business meals, equipment depreciation – all reduce the income lenders can count.

Profit and loss statements help tell your current story, especially if this year looks better than last year’s tax returns. Bank statements show cash flow patterns. Some lenders love them, others barely glance at them.

Keep your 1099s organized. K-1s if you’re in a partnership. Year-end profit reports signed by your CPA carry weight. One client of ours, a freelance graphic designer, landed her loan because she had meticulously organized monthly P&L statements that showed her income trending up consistently.

Self-Employed Mortgage Application Checklist

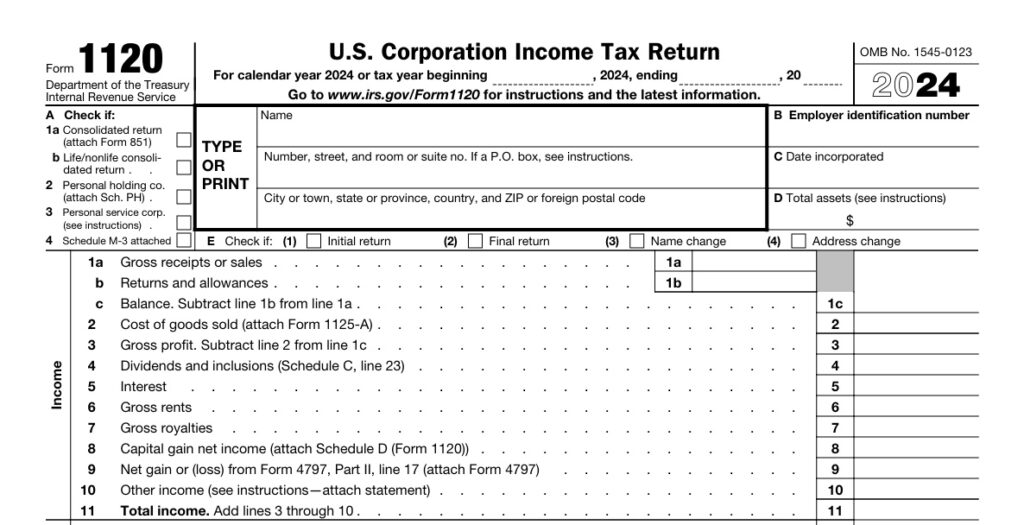

Personal and Business Tax Returns or IRS Tax Transcripts (Last 2 Years)

Include all schedules (especially Schedule C, E, or F).

If applicable, provide corporate or partnership returns (Form 1120, 1120S, or 1065).

Year-to-Date Profit and Loss Statement

Should be signed and dated by you or your CPA.

Helpful if current income exceeds last year’s reported income.

Business Bank Statements (Most Recent 2 Months)

Demonstrates consistent cash flow.

Some lenders may use these to supplement income analysis.

1099 Forms (Most Recent 2 Years)

Confirms income from contract or freelance work.

K-1 Statements (If Applicable)

For partnerships or S-corporations showing your share of income.

Year-End Financial Statements

CPA-prepared or signed reports add credibility.

Business License or Proof of Self-Employment

Verifies the business is active and legitimate.

Signed CPA Letter (Optional but Beneficial)

Confirms self-employment history and income trends.

Personal Identification and Credit Documentation

Valid ID, Social Security number, and recent credit report.

Top Mortgage Programs for Self-Employed in Michigan

Conventional Loans for Self-Employed

Conventional loans offer the most flexibility once you qualify. You can put down as little as 3%, though 20% avoids private mortgage insurance. The income documentation requirements are strict, but the rates are competitive.

FHA Loans for Self-Employed

FHA loans are self-employed borrowers’ best friend. The 3.5% down payment helps when you’ve been reinvesting profits back into your business. Mortgage insurance premiums sting a bit, but qualification guidelines are more forgiving.

VA Loans for Self-Employed

Self-employed veterans hit the jackpot with VA loans. Zero down payment, no mortgage insurance, and lenders who understand military contractor income. A veteran electrician we worked with saved $400 monthly compared to conventional financing. High debt to income ratios are allowed with VA loans opening up opportunities for approval.

USDA Loans for Self-Employed

USDA loans work magic in rural Michigan. Zero down payment in eligible areas, which covers more of Michigan than you’d expect. Perfect for that custom furniture maker setting up shop in a small town. Keep in mind, USDA loans have the most strict DTI requirements. If you do not show much income on paper, USDA loans are not for you.

Bank Statement Loans for Self-Employed

Bank statement loans save the day when tax returns don’t tell your full story. These portfolio lenders look at 12-24 months of business bank deposits instead of tax returns. Non-QM loans typically have rates that run higher, but approval odds improve dramatically.

How to Improve Your Approval Odds with Mortgages for Self-Employed

Credit score improvement isn’t rocket science, just discipline. Pay existing accounts on time, keep credit card balances under 30% of limits, and don’t close old accounts. Quick wins include disputing errors and asking for limit increases on cards you never max out.

Debt-to-income ratio math is simple: make more money or owe less money. Since increasing self-employment income takes time, focus on the debt side. Pay off credit cards, trade down on car payments, or postpone that equipment loan until after closing.

New business owners need to build paper trails fast. Open business bank accounts, get a business credit card, and document everything. Keep personal and business expenses separate. Your future mortgage application will thank you.

Michigan mortgage brokers know local lenders who love self-employed borrowers. They shop multiple lenders for you, while direct lenders only offer their own products. The choice depends on whether you want options or simplicity.

Michigan-Specific Incentives and First-Time Buyer Programs

Michigan rolls out the red carpet for first time homebuyers, including self-employed ones.

Our Conventional 1% down mortgage may be a great fit for self-employed borrower that are low on cash but have great credit. This is a 3% down mortgage where we can credit up to 2% back towards your down payment and you bring only 1% to the table.

Local programs vary wildly. Detroit offers forgivable loans for home purchases in certain neighborhoods. Grand Rapids has employer-assisted housing programs. Kalamazoo’s historic district offers tax credits that effectively reduce your monthly housing costs.

Down payment assistance grants exist throughout Michigan. Some are income-based, others target specific professions or neighborhoods. A self-employed teacher in Lansing recently combined three different assistance programs to buy her first home with just $1,000 out of pocket.

Program applications require patience and paperwork, but the savings are real. Start the process early since some programs have limited annual funding.

Interest Rates, Fees, and Cost Comparison with Mortgages for Self-Employed

Some programs such as NON-QM loans for Self-employed borrowers typically have 0.125% to 0.25% higher rates than W-2 employees. It’s the price of income complexity and extra risk for the mortgage lender. In 2025’s rate environment, that might mean 7.00% instead of 6.75% for a conventional loan.

APR comparisons matter more than rate shopping mortgage for self-employed. A lender offering 7.00% with $5,000 in fees might cost more than one charging 7.125% with $2,000 in fees. Always compare the APR and total costs and discuss break even timelines with your loan officer.

Common fees include origination (0%-1% of loan amount), discount points (0%-2% of the loan amount), appraisal ($400-600 or more for multi unit homes), and underwriting ($895-1195). Third party fees required to get a mortgage include title insurance, recording fees, inspection fees and prepaid items.

When comparing mortgages for self-employed be sure discuss your goals with your loan officer. Is it more important to you to have the lowest possible rate and payment to optimize cash flow or would you rather get the property with the lowest closing costs and money out of pocket. Your mortgage broker can help structure the loan to meet your objectives.

Mortgages for Self-Employed: Step-by-Step Application Process

Pre-qualification gives you a rough estimate based on basic information. Pre-approval involves actual document review and credit checks. Self-employed borrowers need pre-approval letters to be taken seriously by sellers.

Your mortgage team matters. A buyer’s agent who understands self-employed challenges, a loan officer experienced with alternative documentation, and a CPA who structures your finances for mortgage approval. We’ve seen deals fall apart when team members don’t communicate.

Michigan closings typically take 30-45 days for self-employed borrowers. Complex income documentation adds time. The process involves application, processing, underwriting, approval, and closing. Each step has potential delays.

Common pitfalls include surprise tax returns that show lower income, missing business licenses, or co-mingled personal and business accounts. One entrepreneur nearly lost his deal because he forgot to mention rental property income that showed up on his tax returns.

Mortgages for Self-Employed: Step-by-Step Application Process

1. Initial Preparation

Review your credit report and score.

Check all three bureaus (Equifax, Experian, TransUnion) for accuracy.

Resolve any errors or outstanding issues before applying.

Organize financial documentation.

Two years of personal and business tax returns (including all schedules).

Year-to-date profit and loss statement and balance sheet.

Business license or proof of self-employment (1099s, client contracts, etc.).

Two to twelve months of personal and business bank statements (Depending on program).

Stabilize your income and expenses.

Avoid large business write-offs that reduce taxable income.

Maintain consistent deposits and minimize co-mingling of funds.

Consult your CPA or accountant.

Review your tax returns for mortgage readiness.

Verify your income calculations align with what lenders will use.

2. Pre-Qualification

Submit basic financial information to your loan officer.

Provide estimated income, assets, and debts for an initial review.

Receive a rough idea of how much you may qualify for.

Discuss loan programs and goals.

Conventional, FHA, bank-statement, or non-QM loan options.

Review interest rate ranges, down payment needs, and reserve requirements.

3. Pre-Approval

Provide full documentation for income and credit review.

The lender verifies your income, credit history, and debt-to-income ratio.

Receive a pre-approval letter.

This shows sellers you are a qualified buyer.

For self-employed borrowers, pre-approval is essential to be taken seriously.

Review pre-approval terms carefully.

Confirm loan amount, estimated rate, and any conditions that must be met later (e.g., updated tax returns, proof of business continuity).

4. Home Search and Offer

Work with a buyer’s agent who understands self-employed challenges.

Ensure communication between your agent, lender, and CPA.

Submit an offer and provide your pre-approval letter.

Include necessary documentation for a smooth negotiation.

Offer accepted — move to full loan application.

5. Loan Application

Complete the formal loan application (URLA).

Provide details on employment, income, assets, and property information.

Pay for the credit report and possibly an appraisal deposit.

Provide updated documentation if requested.

Sometimes lenders require the most recent statements or P&L updates.

6. Processing

Loan processor reviews your file for completeness.

Orders appraisal, title work, and verification of employment/business existence.

Respond promptly to any conditions or document requests.

Delays often occur here due to missing documents or incomplete verification.

Lender verifies your business activity.

May request CPA letter, business license, or recent invoices to confirm ongoing income.

7. Underwriting

Underwriter reviews your full application and documents.

Checks credit, income, assets, and property appraisal.

Conditional approval issued.

You’ll receive a list of remaining “conditions” (e.g., explanations for deposits, updated income docs).

Submit all conditions quickly.

Keep communication open between you, your CPA, and the lender.

8. Final Approval and Closing Preparation

Underwriter issues “clear to close.”

All conditions have been met and loan is ready for final documents.

Schedule closing.

Michigan closings typically take 15–45 days for self-employed borrowers.

Review the Closing Disclosure (CD).

Sent at least three business days before closing.

Verify loan terms, fees, and funds needed to close.

9. Closing

Attend the closing appointment.

Sign final loan documents.

Provide certified funds or wire transfer for your down payment and closing costs.

Loan funds and property title transfers.

You officially become the homeowner.

10. After Closing

Set up mortgage payments and escrow accounts.

Confirm due dates and online payment access.

Maintain financial organization.

Keep business and personal accounts separate to simplify future refinances or home purchases.

Expert Tips and FAQs on Mortgages for Self-Employed

“Can I use just one good year of business profits?” Not usually. Lenders want two years to calculate average income, though some portfolio lenders make exceptions for strong financials.

“What if I filed a tax extension?” No problem, as long as you have signed returns before closing. Extensions are common for self-employed folks, and lenders understand.

Michigan mortgage professionals share these insider tips: document everything, separate business and personal finances completely, and consider timing your application after filing taxes that show strong income.

Avoid these mistakes: don’t make large deposits without documentation, don’t change business structure during the loan process, and don’t forget to report all income sources, including that side consulting gig.

Refinancing makes sense when rates drop significantly or your income documentation improves. New purchase loans offer more program options but require more documentation. Choose based on your current situation, not what might happen later.

Navigating mortgages as a self-employed borrower in Michigan be a frustrating process, but with the right preparation and know-how, you can secure competitive financing in 2025. From gathering the proper paperwork to selecting the best loan program, each step brings you closer to turning your Michigan homeownership dreams into reality.

Ready to take the next step? Contact a local mortgage broker today at 800-555-2098 and put this guide to work for you!

800-555-2098

800-555-2098