Today is an exciting day for independent mortgage brokers! Our #1 lending partner United Wholesale Mortgage (UWM) completed their IPO to go public on the New York Stock Exchange under ticker UWMC.

UWM has been the #1 wholesale lender in the nation for 7 years running. They are the #2 overall lender but have major plans to take the top spot in the upcoming years with goals of closing over 200 billion dollars in loans in 2021. By becoming a publicly traded company, UWM will have access to capital to invest in technology, staffing and their mortgage broker partners.

Mortgage Brokers Win Big

“They have the best system as far as delivering and getting it done,” said Anthony Bird, mortgage broker and owner of Riverbank Finance LLC in Grand Rapids who has worked with UWM for a decade. “I can close twice as many loans with the same amount of staff and resources. When we get calls from other lenders, they say they are working on some new website or tech features that UWM has.”

Anthony Bird, Owner of Riverbank Finance LLC, was quoted in the Detroit Free Press on 01/22/2021 regarding the UWM IPO announcement.

Riverbank Finance LLC is proud to be partnered with UWM to offer some of the fastest loan closings in the industry with highly competitive interest rates.

Technology Equals Lower Costs and Lower Rates

With UWM’s investment in cutting edge technology, mortgage brokers can compete with the big banks and lenders with a digital mortgage experience. Mortgage brokers are gaining market share with lower costs to produce a loan using new technology and automations. By having the best technology and operating with less expenses, mortgage brokers can offer lower rates and costs compared to many big lenders.

- Digital Mortgage Experience

- eSign Loan Application

- Secure Document Portal

- Automated Income Verifications

- Automated Asset Verification

- Appraisal Waivers Possible

Speed in Lending Wins

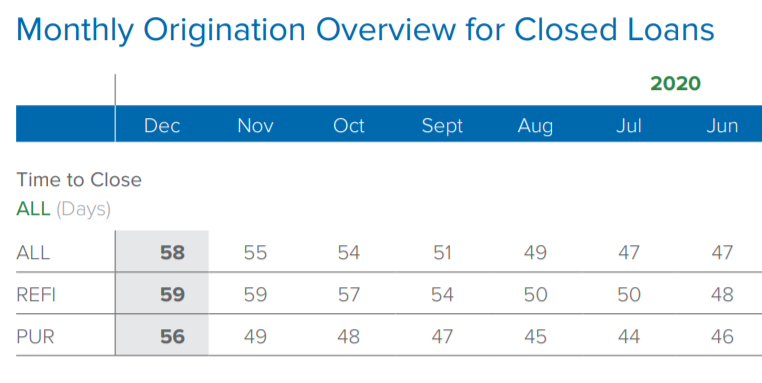

As of December 2020, the average time to close a mortgage was 58 days according to the Ellie Mae Lending Insights Report. UWM advertises 13.3 days on average for the same period which is less than a quarter of the time of its competitors. Mortgage brokers that utilize UWM systems can close mortgages in record time winning important Realtor partnerships.

Not Just Refinance Loans

Many of the big online lenders such as Quicken Loans focus primarily on refinance loans. This helps them to close a high volume of loans while mortgage rates are low, however, many home buyers would much rather work with a local independent mortgage broker.

A large portion of UWM’s loans are purchase loans submitted by mortgage brokers like Riverbank Finance of Grand Rapids, MI. Home buyers typically feel more comfortable having a local mortgage expert they can trust to help answer questions and get them the best mortgage for their situation.

Partnered with UWM

Riverbank Finance embraces their partnership with UWM to offer low rates, low costs and quick closings for Michigan home loans. As a mortgage broker, we can compare mortgage rates from UWM and tens of mortgage lenders to offer some of the most competitive mortgage programs available.

To apply with Riverbank Finance call us today at 800-555-2098 or request information below.

800-555-2098

800-555-2098