The first step to becoming a homeowner is applying for a mortgage. This is a crucial step in the home buying process that cannot be overlooked. Many times, real estate agents even require that you are preapproved by a mortgage company before they will spend their time showing you homes. It is important to know that you will be able to qualify for a home loan once you find the home of your dreams.

Additionally getting preapproved to buy a home, you will be able to confirm your price range. You certainly would not want to be looking at $250,000 homes if you want to keep your mortgage payments under $500 per month. Your loan officer will review your income, assets, and confirm that any credit issues are dealt with prior to placing an offer to buy a home.

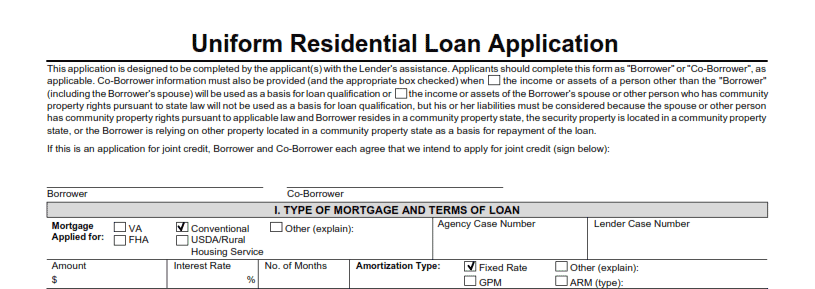

When you are ready buy a home, we recommend finding a local mortgage company and speaking with a licensed loan officer. You may take recommendations from your Realtor or simply do a Google search to find a lender you are comfortable working with. Whether you choose a bank or mortgage company, the mortgage process will be the same. The standard form used to collect borrower information is called a Uniform Residential Loan Application. This form is commonly referred to in the mortgage industry as the 1003 (Fannie Mae 1003 Form). Here is how to apply for a mortgage:

Mortgage Type, Interest Rate and Loan Terms:

The first section of a mortgage application is selecting the loan type, interest rate and loan terms. While your loan officer may advise you on what loan type may be best for your situation, you have the option to apply for the mortgage of your choice. Common mortgage options including Conventional Loans, VA Loans, FHA Loans and USDA Rural Housing Loans. The loan term is the length of the mortgage you are applying for. Common loan terms include a 30 year fixed rate, 20 year fixed rate and a 15 year fixed rate mortgages. The last section you will decide between a fixed rate mortgage (FRM) and and adjustable rate mortgage (ARM).

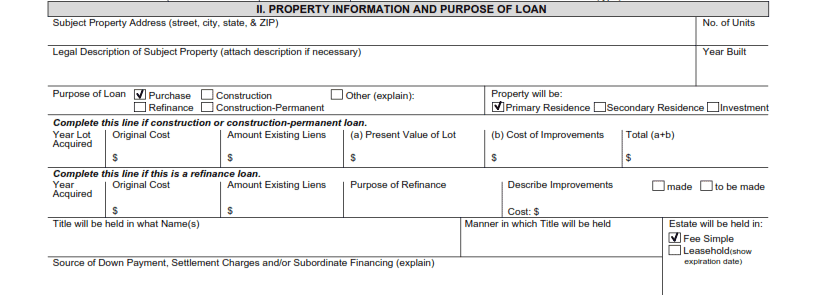

Property Information and Purpose of Loan:

The second section of the mortgage application is the property information and purpose of your loan. This section you will explain why you are applying for a mortgage. Common reasons for applying for a mortgage include purchasing a home, refinancing, new construction or home renovations. You will also indicate whether you will be living in the home as your primary residence, using the property as a second home or vacation property or if you will be renting the home as an investment property.

If you know details about the home, you will complete the address, city state and zip. If you are refinancing then you will complete the details about your current loan and if you are applying for a construction loan then you will complete the construction loan section. If your are buying a preexisting home then leave these sections blank.

Lastly you will indicate the source of the down payment. Common down payment sources include retirement funds, checking or savings accounts, or the proceeds from the sale of your current home.

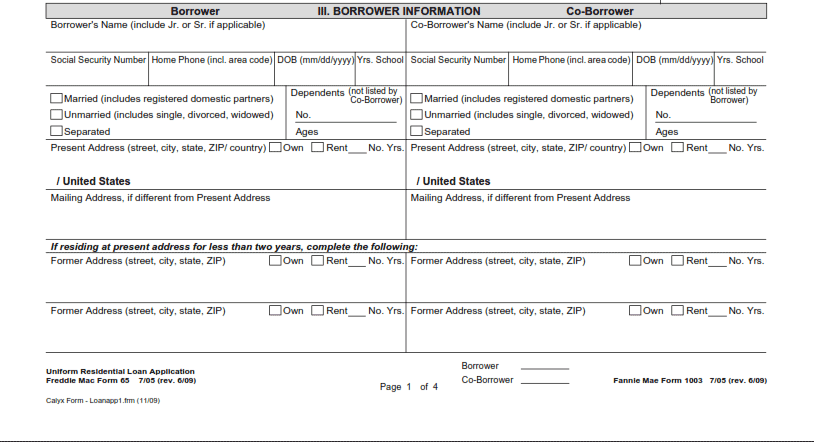

Borrower Information Section:

The third section of a mortgage application is the borrower information section. This section you will indicate whether you are applying for a home loan by yourself or if you will be using a co-borrower. You will be required to put your full name including your first name, middle initial and last name. Next you will need your social security number and date of birth so your loan officer can pull your credit report. Additional details such as marital status (married, unmarried or separated), home phone number, dependents and present address are required.

Employment Information:

Section four of the mortgage application is for Employment Information. Borrowers are typically required to provide a two year work history of employment. Details such as employer name and address, years on the job, positions and business phone number are required. You will also need to complete your monthly income information for prior jobs in this section.

Section four of the mortgage application is for Employment Information. Borrowers are typically required to provide a two year work history of employment. Details such as employer name and address, years on the job, positions and business phone number are required. You will also need to complete your monthly income information for prior jobs in this section.

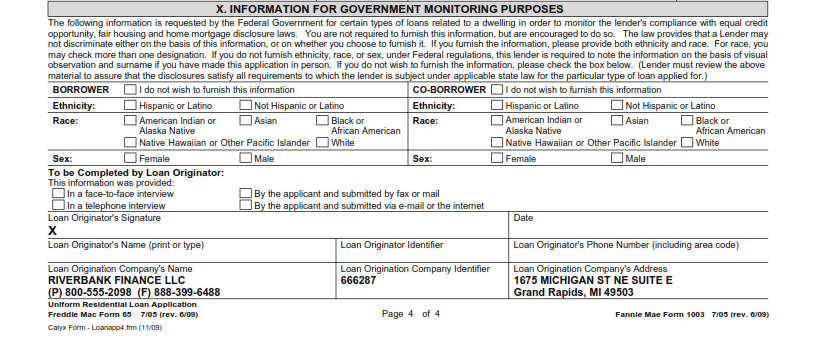

Monthly Income and Combined Housing Expense Information:

The fifth section to the mortgage application is Monthly Income and Combined Housing Expense Information. This section you will start to dive into the numbers of your home loan. You will detail your current income information by breaking down base income, overtime, bonuses, commissions and other income such as business or rental income. The right side will compare your current mortgage or rent payments vs your new estimated mortgage payments. The payment is broken down into Principal and Interest (P&I), insurance, real estate taxes, mortgage insurance (PMI) and home owners association fees.

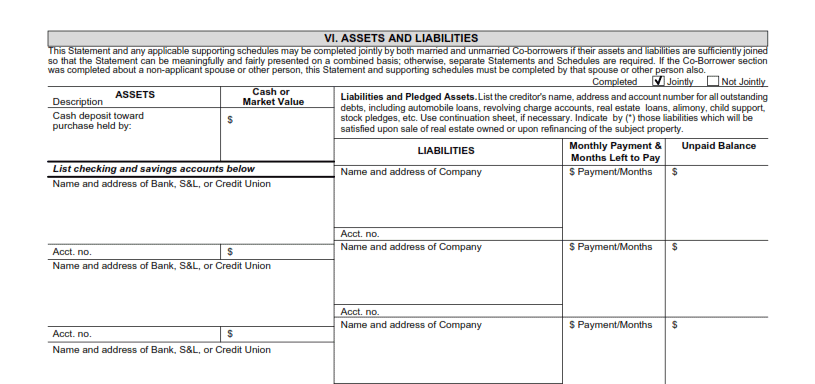

Assets and Liabilities:

The sixth section to your mortgage application is for assets and liabilities. This section you will list any assets such as checking accounts, savings accounts, retirement accounts, automobiles and other assets. Many times you will only need to list the assets that you will use towards the purchase of the home; automobiles and retirement accounts may not be required.

Liabilities are also listed in this section. You will be required to list the name of your creditors, monthly payments and balance owed on your debts. Your liabilities are typically populated when your loan officer pulls your credit report however if you have additional loans that do not report to the credit bureaus you will need to report them here.

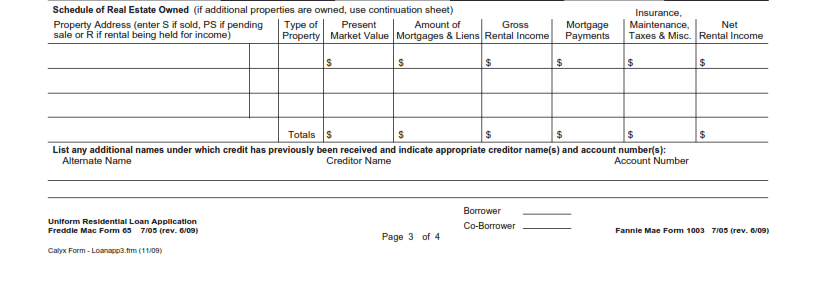

Schedule of Real Estate Owned (REO):

Included in section six of the mortgage application is the Schedule of Real Estate Owned (REO). This is where you will list any real estate property that you currently own. These properties include your current home (if applicable), vacation homes, investment properties and vacant land. You will need to include property type, current market value, loan amounts, mortgage payments, taxes and insurance.

Included in section six of the mortgage application is the Schedule of Real Estate Owned (REO). This is where you will list any real estate property that you currently own. These properties include your current home (if applicable), vacation homes, investment properties and vacant land. You will need to include property type, current market value, loan amounts, mortgage payments, taxes and insurance.

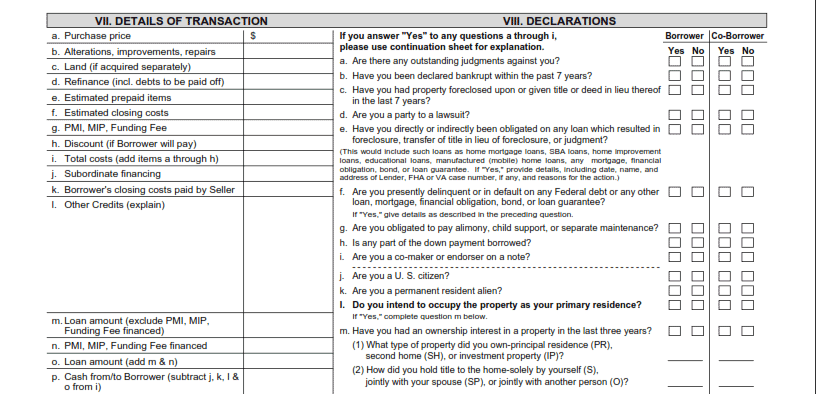

Details of Transaction and Declarations:

Section Seven is the Details of Transaction. This is the detailed list of costs including purchase price, estimated fees, prepaid items and closing costs. The section will also detail the loan amount and the estimated cash required from the borrower at closing.

Borrower Declarations

Section 8 is the declarations from the borrower. The borrower will need to respond to a series of questions about their current situation. These questions are regarding prior bankruptcies, law suits, child support, residency status (citizenship status), and prior home ownership history.

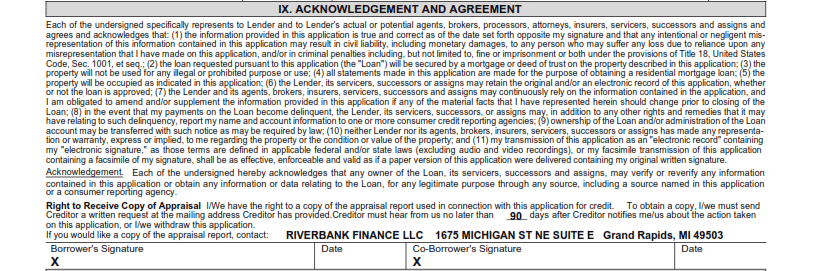

Acknowledgement and Agreement:

Section nine of the mortgage application is the acknowledgement and agreement. This section is a large paragraph of legal jargon that the borrower must read and agree to. In summary, this section states that the information you provided is true and accurate, and if you do not pay, your mortgage lender may report delinquency to the credit agencies. Near the bottom you are advised of your right to receive a copy of the appraisal report.

Information for Government Monitoring Purposes:

The tenth section of the mortgage application is Information for Government Monitoring Purposes. This section is information about your Ethnicity, Race and Sex The purpose of this information is to insure that your lender complying with equal credit opportunity and fair housing laws. You are not required to provide this information. If wish to not provide this information the lender is required by law to guess based on physical appearance so do not be offended if this information is inaccurate.

Ready to buy a home? Apply now online:

Download printable 1003 Mortgage Application or complete the form below to be personally assisted in the loan application process.

800-555-2098

800-555-2098