Housing Inventory Reaches 18-Year Low

The number of active listings dropped again last month to the lowest level since 1999, according to the National Association of Realtors. Only 1.65 million homes are available for sale, which equates to roughly 3.6 months of inventory nationwide. This figure is downward from the 3.9 months of inventory reported in December 2015. A healthy, balanced market should have about six-months of inventory. See NAR’s infographic below for additional statistics on national home sales.

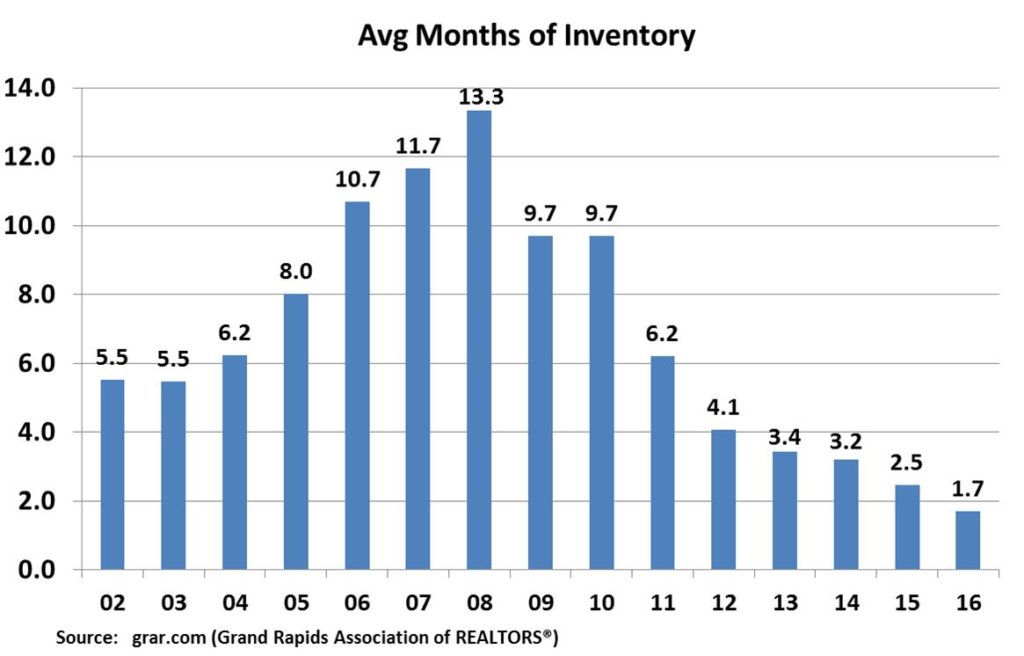

Housing Inventory in West Michigan

Here in West Michigan, the situation is even more dire. According to statistics from the Grand Rapids Association of Realtors, we closed out 2016 with only 1.7 months of inventory. This means that if no additional homes entered the market for sale, at the current sales pace, all existing listings would be scooped up in less than two months. As shown by the graph below, inventory levels in West Michigan have been on a steep decline for the last decade.

You may be wondering, what is causing the housing shortage? Experts blame a combination of rising demand and stagnant new home construction. Single-family housing starts are growing, but only at a snail’s pace. Builders are still struggling to operate at pre-housing crisis levels, due to the loss of skilled trades and increased labor and materials costs.

What does this mean for the upcoming Spring real estate market? Prospective buyers can expect cutthroat competition—multiple offers, over list price, in less than 24 hours, without contingencies. There won’t be time for second showings or “sleeping on it”. And shopping for a home before being pre-approved? Don’t even think about it!

What about the remaining homes for sale? Why aren’t they selling? Many times, it is due to the condition of the home. Most buyers do not have the time, desire, or cash to remodel a home top to bottom. Enter renovation mortgage programs! Renovation mortgage programs such as the Homestyle Renovation or FHA 203k programs allow borrowers to purchase and remodel the home of their dreams in one fell swoop.

How do Renovation Loans work?

Logistically speaking, a homebuyer, after agreeing to purchase a home for a set price, attains quotes from contractors to have renovations done. An appraisal of the home is then done, taking into account the home’s value once renovations have been completed. You can then borrow up to 96.5% of that appraised value. As soon as closing takes place, funds for renovations are placed in an interest-bearing escrow account and construction begins. Once renovations are complete, a final inspection takes place, the contractors are paid out of the escrow, and you move in to your beautifully renovated new home!

Get More Information

To apply for a Mortgage or Refinance call Riverbank Finance today at 1-800-555-2098.

800-555-2098

800-555-2098