Have you ever wondered, “How much is my home worth?” Whether you’re looking to sell, refinance, or just assess your property’s value, using a home value estimator can be helpful. According to Zillow, homeowners who understand their home’s value make better financial decisions regarding selling, buying, and home improvements! In this guide, we will review how home value estimators work, accuracy, the best home value estimator tools to use, and expert tips to ensure you get the best property valuation.

What Is a Home Value Estimator and How Does It Work?

A home value estimator is an online tool that provides an estimated market value for a property based on publicly available data. These estimators rely on various sources, including recent sales data, tax assessments, and real estate market trends, to determine an approximate value for a home.

These online tools are automated based on the limited data available for your home. While values may not be exact, it can be a great way to estimate your home value.

How Online Home Value Estimators Pull Data

Online estimators pull data from multiple sources, including county records, MLS (Multiple Listing Service) data, tax assessments, and recent home sales in the area. They will also use information about your home’s bedroom count, bathroom count and square footage to compare to other homes that have sold. The tool analyzes the information and creates a probable valuation based on comparable sales and market conditions.

What is an Automated Valuation Models (AVM)

Automated Valuation Models (AVM) are algorithms used by home value estimators to calculate property values. These models analyze vast amounts of data, including historical sales, property characteristics, and market trends, to determine an estimate. While AVMs are useful for providing quick valuations, they may not account for unique features or recent upgrades that could affect the home’s value.

Why Property Values Fluctuate Over Time

Several factors cause a home’s value to change over time, including economic conditions, local market trends, and property improvements. Since a home’s true value is how much it would sell for, the value of comparable sales changes over time.

Supply and demand shift in your area will be a main reason for home values changes. Other factors that may make a home gain or lose value based include interest rates, nearby development projects, and buyer preferences.

The Key Factors That Affect Your Home’s Value

Several critical elements influence how much a home is worth. Understanding these factors can help homeowners better estimate their property value and make improvements that increase their investment.

Location and Neighborhood Trends

One of the most significant factors impacting home value is location. Buyers often prioritize desirable neighborhoods with access to amenities and strong community appeal.

- Proximity to schools, public transportation, and amenities – Homes near highly rated schools, parks, public transit, and shopping centers tend to have higher values.

- Recent home sales in the neighborhood – The price at which comparable homes (comps) in the area have recently sold can greatly influence a home’s estimated value.

Home Size Layout and Building Style

The size and flow of a home play a role in determining its worth.

- Building Style – A home building style will affect the value. Many homebuyers look for features such as a ranch home and would not consider a bi-level home. Also Stick Built homes generally have higher value than manufactured homes.

- Square footage and number of bedrooms/bathrooms – Larger homes with more bedrooms and bathrooms tend to be worth more, but the distribution of space also matters.

- Open concept vs. traditional layouts – Open floor plans are popular in modern homes and can raise a property’s value, while outdated or inefficient layouts may reduce it.

Property Condition and Upgrades

The physical state of a home significantly impacts its valuation.

- Renovations that increase home value – Upgrades to kitchens and bathrooms, energy-efficient features, and well-maintained outdoor spaces often boost property value.

- Outdated features that lower home value – Dated interiors, old appliances, or lack of modern updates may negatively impact a home’s worth.

Market Conditions and Economic Trends

External economic factors influence home prices on a broader scale.

- How interest rates affect home value – When mortgage rates are low buyers have more buying power and can buy more expensive homes for the same payment which leads to higher home values. Rising rates can lower demand and decrease prices.

- Housing supply and demand dynamics – If there are more buyers than available homes, property values typically increase due to competition. High inventory can do the opposite and drive prices down.

The Best Online Home Value Estimator Tools in 2025

There are ton of online home valuation tools available. Each home value estimator tool has its own features and limitations. A good idea for doing home value research is to use each tool and average the results. For example, if Zillow says your value is $395,000 and Riverbank’s Home Value Estimator gives you a value of $405,000, you could averages these to estimate your value at $400,000.

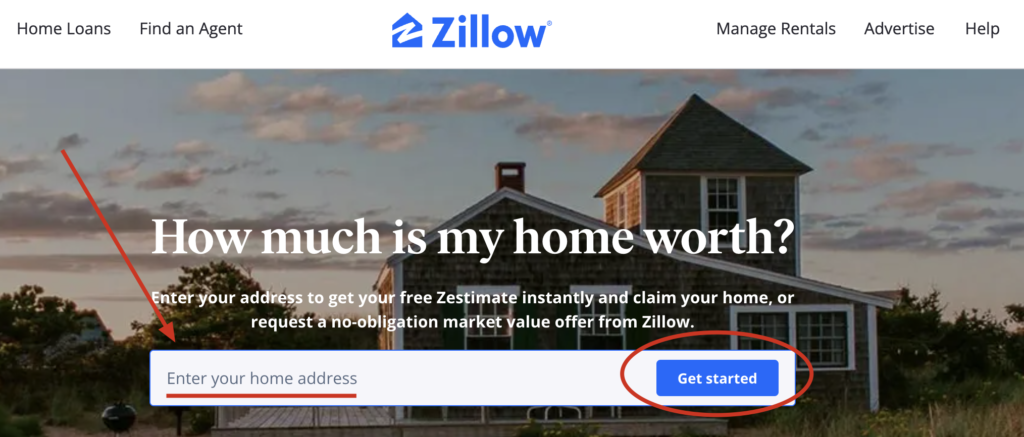

Zillow Zestimate – How Accurate Is It?

Zillow’s Zestimate is one of the most well-known home valuation tools. It uses an AVM to estimate property values based on both public and user-submitted data. While it is widely used, its accuracy can vary depending on the market.

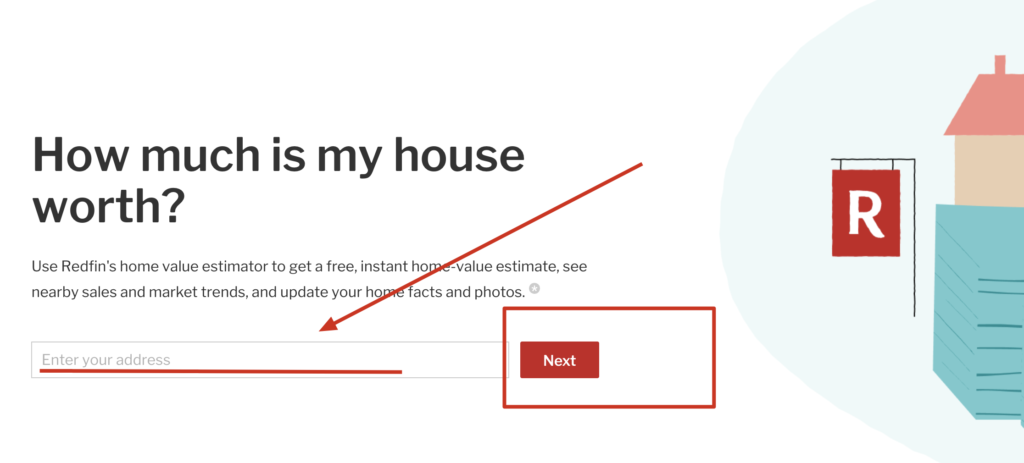

Redfin Estimate – Features and Limitations

Redfin’s home value estimator offers a more refined valuation in markets where it has substantial data. It updates frequently, but like other AVMs, it may not account for renovations or unique home features.

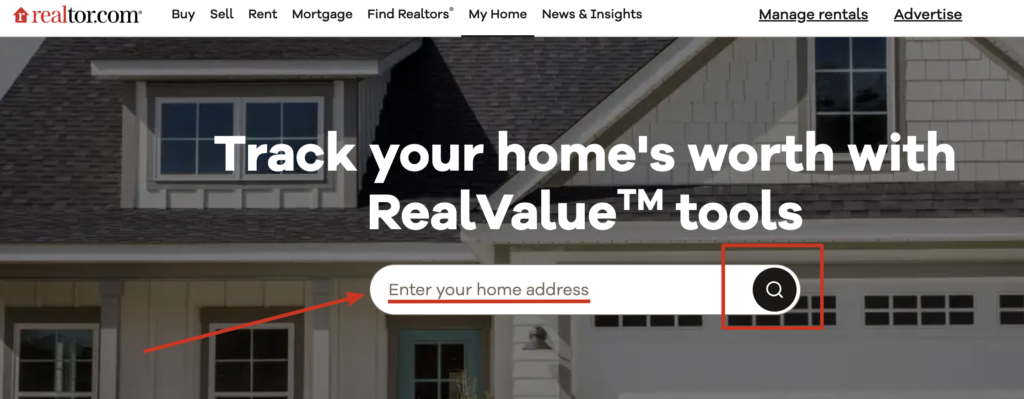

Realtor.com Home Value Estimator

Realtor.com pulls data from MLS listings and market trends, providing an estimate based on recent sales in the neighborhood. However, it may not be as comprehensive as some other tools.

Chase Home Value Estimator

Chase’s estimator is primarily used for refinancing purposes and offers a basic idea of home value. While it is helpful for mortgage holders, it lacks the depth of analysis found in real estate-focused platforms.

Bank of America Home Value Tool

This tool helps homeowners gauge their property’s worth, particularly if they are looking to refinance or take out a home equity loan. However, it may not be as detailed as other estimators.

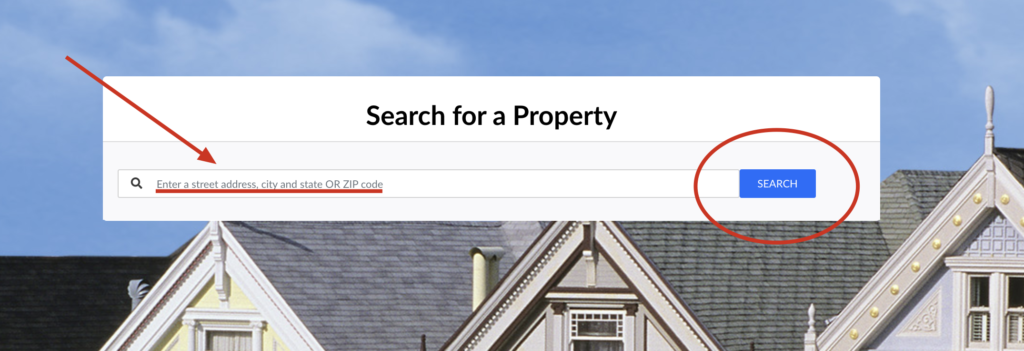

Riverbank’s Home Value Estimator

Use Riverbank’s home value estimator too to get an instant home value. Simply enter your address and click “Check” to get your homes value. Feel free to add your information to receive a monthly update for the value of your home.

Pros and Cons of Using Online Property Value Calculators

Pros:

- Quick and free access to estimated home values

- Useful for getting a general idea of property worth

- Can help gauge market trends

Cons:

- Estimates can vary widely between tools

- May not account for recent renovations or home-specific details

- Cannot replace a professional appraisal

How Accurate Are Online Home Value Estimators?

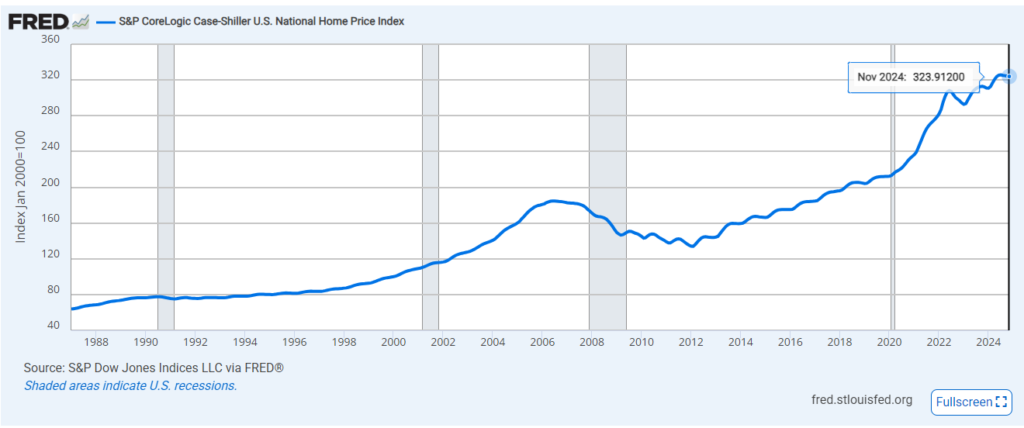

While online estimators provide a convenient way to gauge property value, their accuracy is often debated. In general, home values have increased over time. Check out the Case Schiller Home Price Index to see Home Values over time.

Why Estimates Vary Between Different Home Valuation Tools

Each platform uses unique algorithms and data sources, leading to inconsistencies in estimated values. Some estimators place more weight on recent sales, while others focus on broader market trends.

Factors That Can Lead to Over- or Underestimations

- Lack of recent sales data – In areas where comparable sales are scarce, estimates can be inaccurate.

- Unreported upgrades or damage – Home improvements may not be factored into AVM calculations.

- Market fluctuations – Rapid changes in demand can lead to outdated estimates.

When to Rely on an Online Estimator vs. Hiring an Appraiser

Online estimators are great for a ballpark figure, but if you’re selling or refinancing, hiring a professional appraiser ensures an accurate and legally recognized valuation.

Real Estate Agents vs. Automated Valuation Models (AVMs)

A real estate agent can evaluate a home’s unique features and provide a more accurate comparative market analysis (CMA), while AVMs rely solely on data. This will be one of the best ways to get an accurate home value. Real estate agents will know the local market, what buyers want and will pay for a home and have knowledge of high demand neighborhoods.

A physical inspection by a real estate agent can also be valuable to make value adjustments based on condition, renovations and home features. If you are considering selling your home, agents will be happy to meet with you and prove a home value that they think they could sell your home for.

How to Improve Your Home’s Value Before an Estimation

Making strategic upgrades can boost your home’s valuation.

- Low-cost home improvements with high ROI – Fresh paint, updated fixtures, and deep cleaning can enhance a home’s appeal.

- Enhancing curb appeal – Landscaping, exterior painting, and a welcoming entryway create a strong first impression.

- Smart home upgrades – Adding energy-efficient appliances or smart home features can increase desirability.

- Deep cleaning and decluttering – A clean, well-organized home appears larger and more inviting to potential buyers.

Should You Get a Professional Home Appraisal?

A professional home appraisal offers a more precise valuation than online estimators. Again, an appraiser would do a physical inspection of the property to make adjustments based on the condition. They would also have local market knowledge of your neighborhood.

Difference Between a Home Appraisal and an Online Home Value Estimate

A home appraisal is conducted by a licensed professional who evaluates a property’s condition, location, and market data. An online estimate is based solely on data-driven algorithms.

How Much Does a Home Appraisal Cost?

Typically, a home appraisal costs between $300 and $700, depending on the property’s size and location. Multiunit home will be more expensive in the range of $500 to $1000.

When You Should Hire a Real Estate Appraiser

If you’re refinancing, selling, or applying for a home loan, an appraisal provides an accurate valuation required by lenders. Keep in mind that you cannot pick your own appraiser. The lender must place the order on your behalf and have an independent appraiser selected.

Steps Involved in a Professional Home Appraisal

- The appraiser inspects the property.

- They review comparable sales.

- A detailed report is generated.

- The final valuation is emailed to you to review.

How to Use a Home Value Estimator for Selling & Refinancing

- A high home value can impact refinancing – A higher valuation can lead to better refinance options and lower interest rates.

- Setting a competitive asking price – Estimating market value helps sellers price their homes appropriately.

- Leveraging home equity – Homeowners can use their home value to secure loans for renovations or debt consolidation.

Common Mistakes to Avoid When Using a Home Value Estimator

- Relying solely on automated estimates – These tools provide estimates, not definitive values.

- Ignoring local market trends – Neighborhood changes can significantly impact a home’s worth.

- Not considering home condition – A well-maintained home typically has a higher value than an estimator might suggest.

- Overestimating based on sentimental value – Emotional attachment does not translate into market value.

Understanding your home’s value is important whether you’re selling, refinancing, or just planning home improvements. While home value estimators provide a quick snapshot, combining their insights with a professional appraisal or realtor opinion of value will give you the most accurate estimates.

Need help determining the value of your home? Try one of the online home value estimators mentioned above or consult a local real estate expert for a precise estimate. Reach out to one of our licensed loan officers today at 800-555-2098 if you would like assistance!

800-555-2098

800-555-2098