If you listen to the news, you will get fed consistent updates about how mortgage rates are jumping and how housing markets may be in a bubble. It is no wonder why the average home buyer may second guess their timing to buy a home in 2022.

It is true that mortgage rates have shot up in 2022 compared to the COVID lows of 2020 and 2021. The bigger question should be why were rates so low during this period of time?

The explanation to why rates were the lowest in history is due to the government’s Quantitative Easing referred to as QE. This is the process where the government injects money into the economy by buying bonds to stimulate economic growth. Part of QE was the monthly buying of $40 billion dollars of mortgage backed securities (MBS).

This new demand for mortgage debt through the purchase of mortgage backed securities caused rates to plummet to the lowest rates in history.

Why Have Mortgage Rates Gone up in 2022?

Mortgage rates have gone up in 2022 due to the Federal Reserve tapering their bond buying programs. Inflation has been running hot due to the government’s stimulus. To counteract the high inflation, the Feds have announced plants to do the opposite of QE which is Quantitative Tightening (QT).

The US Government now owns 2.6 trillion dollars worth of mortgage backed securities. Through QT, the goal is to take money out of the economy. They will accomplish this by selling mortgage backed securities and allowing runoff of their mortgage portfolio.

With less buyers for new MBS Notes and the government offloading their portfolio, mortgage rates have been forced up to attract private investors that are seeking higher returns of interest.

Are Mortgage Rates High in 2022?

Now to circle back to the question of this article, “Are mortgage rates high in 2022?” I like to apply the advice of Reggie Watts to gain a higher perspective. He said, “When in doubt, zoom out.”

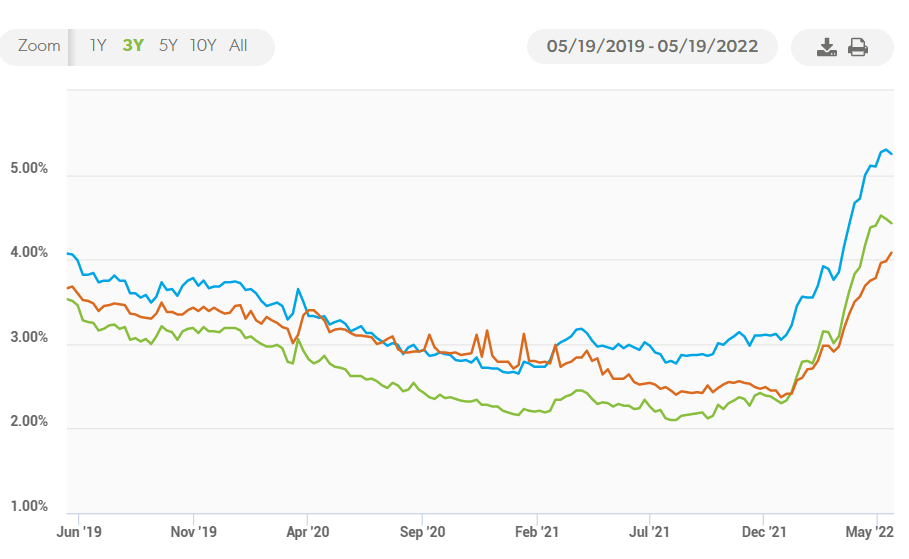

If you look at mortgage rates over just the past couple of years, then you will think mortgage rates are high. They have certainly gone up since the artificially low rates caused by the Feds. If you zoom out, you will notice that mortgage rates are still historically low.

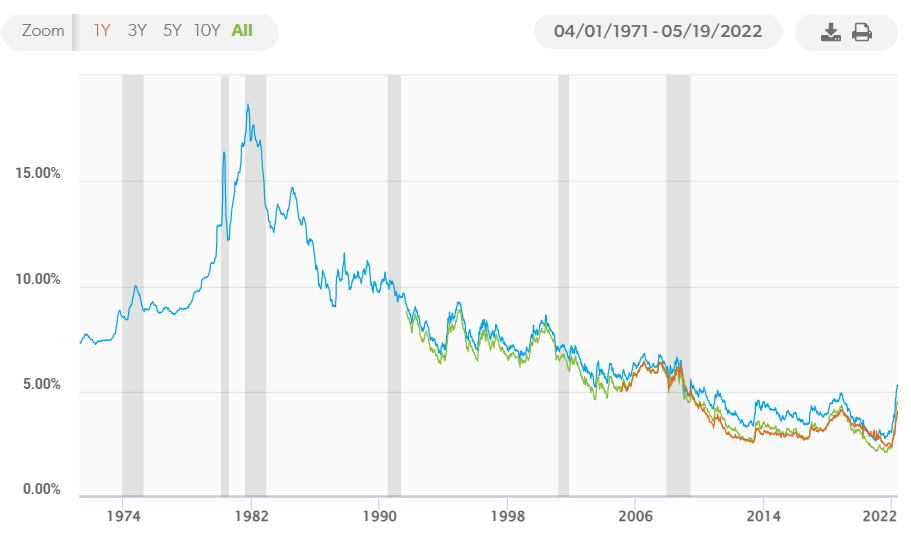

Above is a chart from Freddie Mac which has been tracking the average mortgage rates since 1971. After zooming out to see the full history of mortgage rates. You can see that rates in 2022 are still historically low.

People have been buying homes for the past 50 years with mortgage rates higher than the current rates. Mortgage rates alone are not a reason why someone should decide not to buy a home.

Remember this if you decide to keep paying rent; the landlord that you are renting from will be increasing rents over time with inflation and your payments will be going up over time.

After all, if you are concerned about interest rates, do the math on rent. The interest rate on rent is 100%. The only equity you are building each month is your landlord’s equity.

If you would like more information on buying a home, call a loan officer at 800-555-2098 to get pre-approved or request information below.

800-555-2098

800-555-2098