The Coronavirus has wreaked havoc on the financial markets so far in March 2020. Investors have been fleeing from stocks and investing in lower risk assets such as Bonds, Treasury Notes and Mortgage Backed Securities. This has helped us hit the lowest mortgage rates in history.

The news is quick to report on the low rates and investor’s fear in the equity markets, however, this is only part of the story. The temporary drop in rates slammed banks, lenders and mortgage brokers with refinance applications during this short period of time.

The high volume of mortgage applications combined with a bounce back in rates has put rates back near the levels we started with in 2020.

Hey, guys, Anthony here, owner of Riverbank Finance, an independent mortgage broker here in Grand Rapids. I wanted to do a quick recording for our clients, realtors, and referrals partners, and take on a couple of the myths that we’re hearing out there these days and clear up some confusion on what’s happening with mortgage rates and the economy as we fight with this coronavirus outbreak that’s spreading as a pandemic across the world.

So, everyone knows if they have been watching the news, or reading headlines in the newspaper, or on websites, what’s happening is there’s extreme volatility and we are dealing with a major threat with the coronavirus.

The economic slowdown and the impacts from shutting down major public events is going to have longterm effects on what happens with the profitability of companies here in the United States and globally. Because of that, stocks are adjusting, and people are running from stocks to investing bonds or safer assets. This is causing a world of chaos in the financial markets.

One result of that is a lot of people might have recently seen is mortgage rates did drop to historic lows. So, I want to talk on that and kind of educate everyone on what’s going on with that, and kind of bring everyone up to speed on where we’re at today.

So, the fact is, mortgage rates did his historic lows the first part of March here in 2020. Since then, a lot has happened, and if you’re listening to the news and just looking at a post from people that don’t really follow the data, you might be looking at bad advice and bad information.

The purpose of making this video is to educate. With that said, let’s go ahead and take a look at the data and I’ll try to help explain it in a way that might make sense and connect the dots for you. I’m gonna bring up some charts here on some software that we subscribed to, so bear with me real quick.

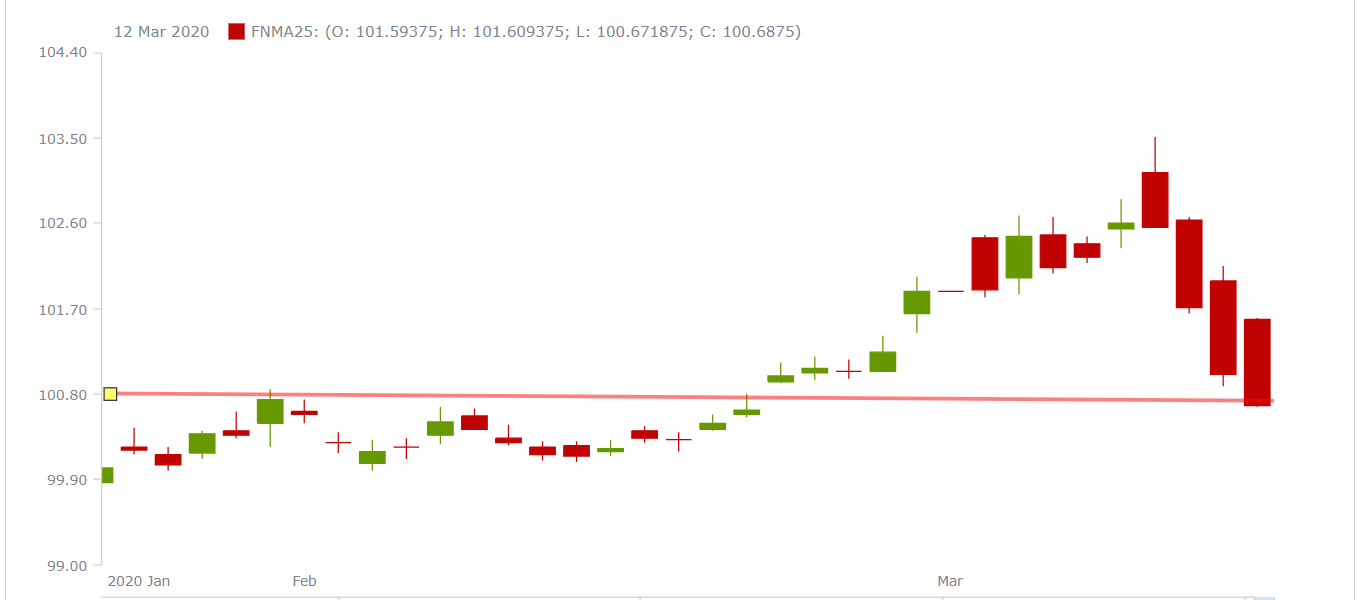

All right, so these charts are tracking the mortgage-backed securities. Mortgage pricing is based on what investors are willing to pay for a pool of mortgage-backed securities. Essentially as we look at this chart, the higher, the better. That means that investors are willing to pay more for mortgage rates at a certain level. Lower is worse for rates.

So, I have here a one-month chart. It’s started lower down, it peaks up, this is where we had the best mortgage rates in history, as everyone heard. Then you see, sharply after this, a steep decline.

So, let’s jump into another chart. This is called a candlestick chart, so it tracks what’s been happening, as far a incremental daily updates on where the rates are at. And again, with this, higher the better, it means that investors are willing to pay more for mortgage-backed securities, which results in lower mortgage rates.

This goes back to the beginning of 2020 here, you can see it’s pretty much flat up until the beginning of March, where we saw mortgage rates starting to get better. About this time is where we saw some of the lowest mortgage rates in history. Now, as you can see, as we proceed into March, and as time goes on, what investors are willing to pay for these mortgage-backed securities has dropped, and if you take a look and just draw a line across it, we’re basically flat on where rates were to start the year.

Now, it doesn’t mean that people can’t save on their mortgages still, it just means the news and everything you’re hearing about rates being the lowest ever, well, that is old news at this point.

It’s important to know the difference, and to know why. Looking at the data and the facts on it is what we want to do as independent mortgage brokers and educators for our clients to explain the why behind it, and not just say, “Sorry, our rates are higher.”

I’m gonna pull up one more chart here and help to answer the next question. A lot of our clients are calling right now and following up with us, and saying, “Hey, does it make sense for me to refinance my house? “Should I jump on this bandwagon and try to drop my rates down?”

Everyone’s saying on the news rates are at historical lows, right? So, this is another chart, it’s stretched out back to 2015-ish. You can kind of see where rates are at, 2016 had some of the lowest rates in history, and if you’ve been around awhile and followed the news, you might have heard that back then, which was true.

You can see, rates did hit that point again here in March in 2020. But as you take a look, the rates are dropping back down. Sorry, the pricing on mortgage-backed securities is dropping back down and kind of leveling off.

If you take a look over the last six months or so, six, eight months, there’s really not much benefit at this point to jumping in and trying to refinance. Now with that said, rates are still great. They’re still near some of the lowest ever, it’s not a question to look at rates in the 3s and take a look to see what you can do.

We always recommend having a conversation with your mortgage broker, take a look, see what you can do, compare the numbers, do a cost benefit analysis and a break even analysis to see how long it would take you to recover any cost to refinance, and make the decision.

Our job is to educate you and give you the information, and you can decide what’s best for your families. So, who might benefit from these historically low rates are people that might have gotten a loan anywhere in the dips after 2016, we experienced a sharp spike right after the elections in mortgage rates, and again, down is bad for rates, that means rates went up, so basically 2016 and then most of 2018, rates were significantly higher than what you’ll find today.

If you got a mortgage in 2018, chances are, you could probably save on your mortgage. If you got a mortgage somewhere in the last six months, probably not saving much. But again, who knows what’s going to happen as the volatility continues in the market and uncertainties plague the United States and the financial market.

Talk to your mortgage broker, let’s review it, and let’s keep a close eye to see if we can lock in savings for you. Any questions, feel free to reach out to us, we’re always here to help and make sure you’re up to date on what the data says.

What are Current Mortgage Rates?

Historically speaking, mortgage rates are still great! Yes, they have jumped from the “Lowest in History” which existed for a couple of days, but now still may a great time to refinance your home.

The chart above shows the price investors are willing to pay for mortgage backed securities (MBS). If the price is higher, mortgage rates drop. If the price is lower, then mortgage rates go up.

According to the data, if you bought a home or refinanced between November of 2016 and August 2019, mortgage rates should be lower than your current rate.

If you are wondering if you should refinance your mortgage, the next step is to speak with your mortgage broker and do a cost benefit analysis to review if a mortgage refinance is right for you.

800-555-2098

800-555-2098