Are you currently in, or recently completed a medical residency or fellowship? Our Doctors’ Loans exclude student loans from your debt-to-income ratio! Call us today at 800-555-2098 and let us discuss your options! Benefits of Doctors Loans in Michigan Doctors can now easily qualify for a mortgage without including student loans in the debt to… Read more »

Category: Mortgage Tips

8 Tips for Moving with Pets

Free Conventional Appraisals

We have some exciting news! Conventional Appraisals are now FREE for new loans submitted to us from 08/26/2018 that close by 12/31/2018! Free Conventional Purchase Loan Appraisals If you are buying a home, then take advantage of the our Free Appraisal program to keep up to an extra $525 in your pocket when we take… Read more »

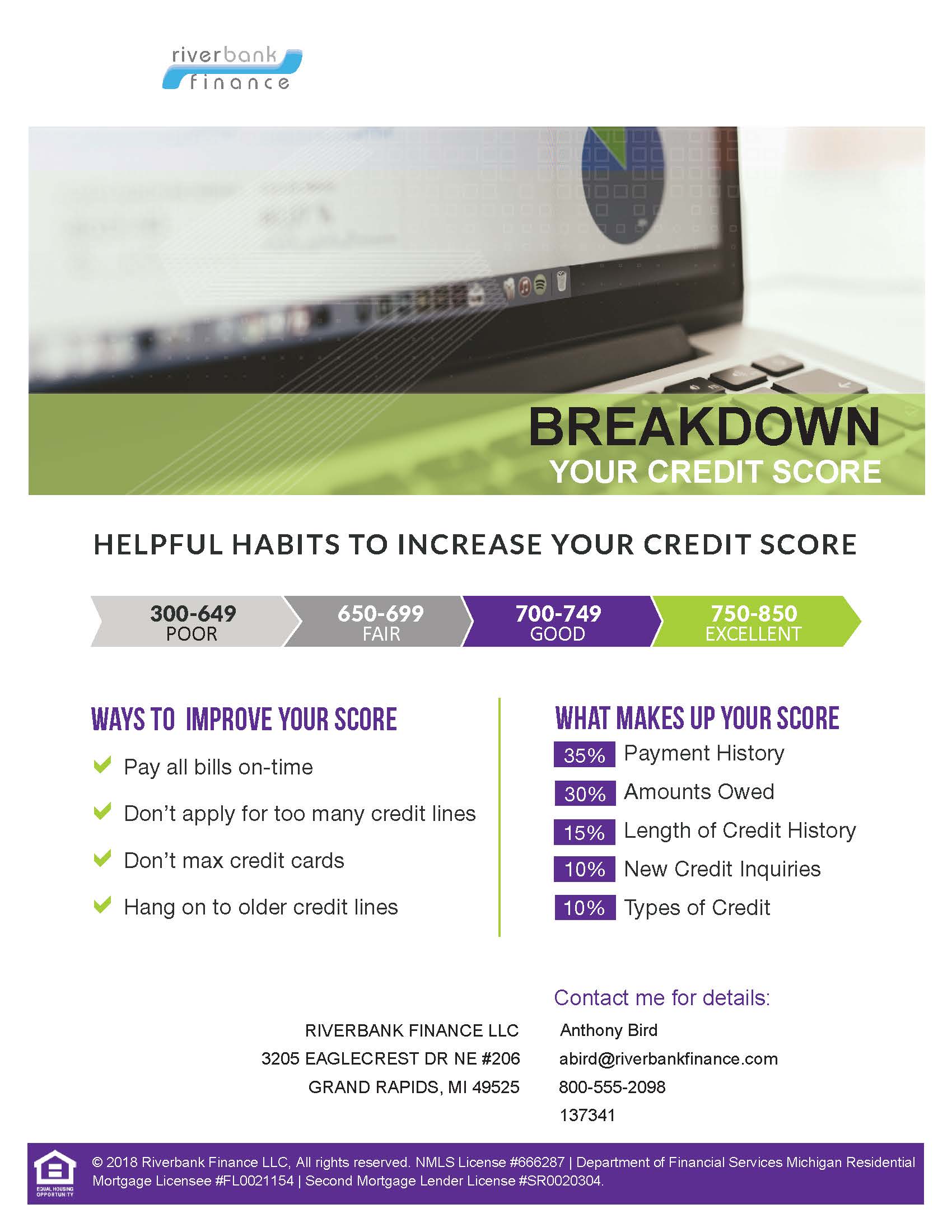

Breakdown Your Credit Score

When buying a home, your credit score is an important factor in your home loan approval. It is important to know what is on your credit and what credit score you have when applying for a mortgage. While, the exact scoring models are proprietary and not released by the credit bureaus to the public, credit… Read more »

Hundreds of Mortgage Options

As local mortgage experts, we are here to help all types of families. We do mortgages. Only mortgages. We do not offer auto financing or credit cards. This allows us to be experts at what we do and have many types of mortgage options for all financial situations. If you have a unique financial situation,… Read more »

How to Get Your Offer Accepted

If you have been searching for a house in the last couple of years, you will be familiar with what the real estate industry calls a “lack of inventory”. This means that there are more people looking to buy houses than there are people interested in selling homes and there is more competition on each home. … Read more »

Conventional Loan vs FHA Loan vs VA Loan vs USDA Home Loans

When shopping for a mortgage it is a good idea to compare loan options. Many lenders offer a variety of home loans that might fit your needs. Each mortgage options has it benefits and weaknesses that should be considered for your individual loan needs. Lending guidelines are not the same for all mortgage lenders. All… Read more »

Budgeting to Become a Homebuyer

You have found yourself in debt, but you have also found yourself wanting to buy a home. You want to pay off the money that you owe all while saving up money for your dream home. It is possible? First off, you should know that you are not alone. Many people find themselves in situations… Read more »

800-555-2098

800-555-2098