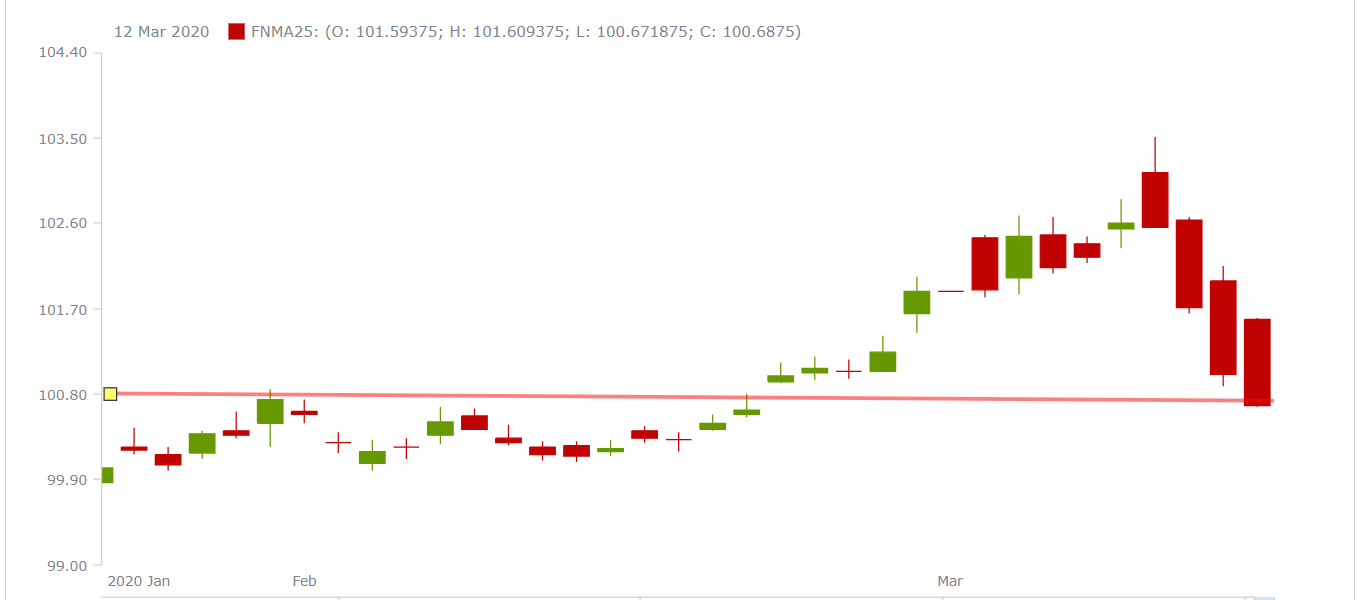

Each year the Federal Housing Finance Agency (FHFA) reviews home appreciation and makes adjustments to the maximum conventional loan limits. With our booming housing market the FHFA was able to increase the new conforming loan limits substantially for 2021. Conventional loans are home loans sold to Fannie Mae and Freddie Mac. Nearly all banks and… Read more »

800-555-2098

800-555-2098