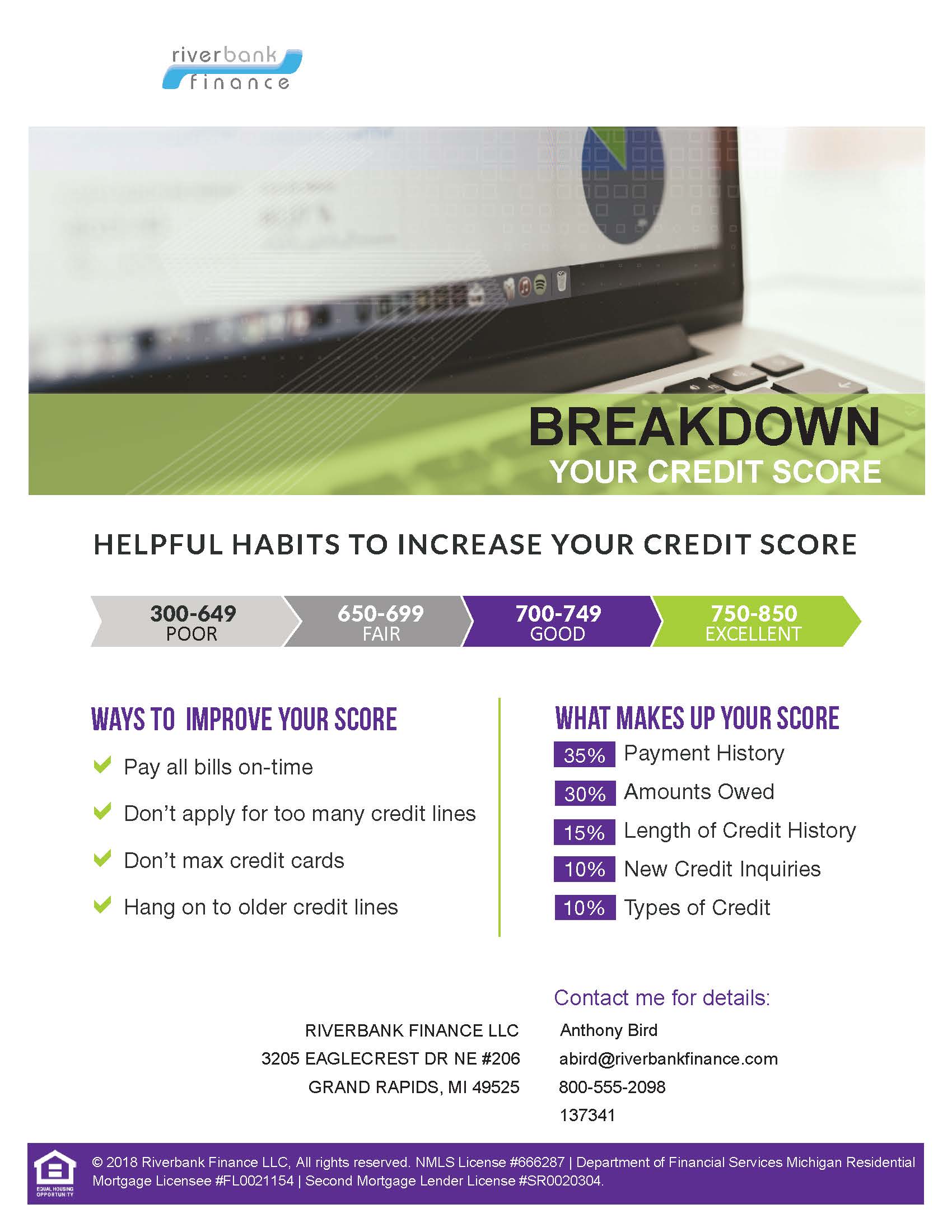

When buying a home, your credit score is an important factor in your home loan approval. It is important to know what is on your credit and what credit score you have when applying for a mortgage. While, the exact scoring models are proprietary and not released by the credit bureaus to the public, credit… Read more »

800-555-2098

800-555-2098