Mortgage rates have dropped yet again in the wake of the Brexit (Britain voting to leave the European Union). The world markets have been very volatile since the news broke early Friday morning. Financial instability brings lower mortgage rates. Now is the best time to buy a home or refinance your mortgage to a lower rates that we have seen in years.

Mortgage rates have dropped yet again in the wake of the Brexit (Britain voting to leave the European Union). The world markets have been very volatile since the news broke early Friday morning. Financial instability brings lower mortgage rates. Now is the best time to buy a home or refinance your mortgage to a lower rates that we have seen in years.

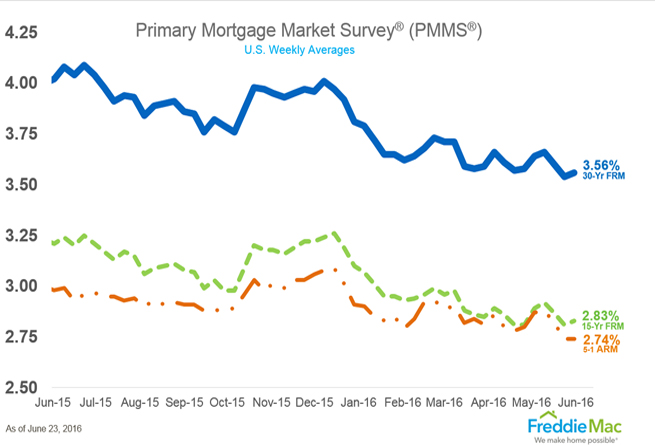

At the start of 2016 average mortgage rates for a 30 year fixed rate mortgage hovered around 4.00%. Industry experts advised that rates would continue to climb as the Federal Reserve announced plans to increase their rates throughout 2016. The results have been quite the opposite with current mortgage rates hitting as low as 3.50% for prime borrowers.

What Do Low Mortgage Rates Mean for Home Buyers?

With mortgage rates near the lowest point in 3 years, home buyers are able to afford more house for the same payments. Here is an example from Riverbank’s Conventional Mortgage Calculator with a home buyer getting a loan of $250,000 to buy a home.

January 2016 with a 30 year fixed rate mortgage at 4.25% would give the home buyer a principal and interest payment of $1229.85.

June 2016 with a 30 year fixed rate mortgage at 3.5% would give the home buyer a principal and interest payment of $1122.61 which is a $107.24 per month savings. For the same payment of $1229.85 a home buyer would be able to get a mortgage of $273,882. This increases their buying power by $23,882 for the same payment!

Why Refinance to a Lower Mortgage Rate?

There are several “rules of thumb” when it comes to refinancing your mortgage to a lower rate. Some say if you can drop your rate by ½ of a percent then it makes sense. Others say if you can do it with no costs then it makes sense. The true answer will be different for each individual circumstance.

The way to tell it if makes sense to refinance your mortgage is if you will save more money than the costs of getting a lower rate. For example if it costs $3000 in closing costs but you save $250 per month you will recover your costs in 12 months ($3000 / 12 = 12 months). In this example if you plan on keeping your home for at least 12 months, then anything after that would be money in your pocket.

Should I Refinance to a 15 Year Mortgage Term?

Many home owners are taking advantage of the low mortgage rates to pay off their mortgage faster without increasing their payment significantly. By refinancing to a 15 year mortgage you may save thousands of dollars in interest over the life of your loan. How is that for retiring early?

Here is an example of a home owner refinancing to a 15 year mortgage from a 30 year mortgage.

The homeowner has a $250,000 mortgage and is currently at 4.5% on a 30 year fixed rate. If he pays the minimum payment he will have paid $206,018.10 in mortgage interest. See Riverbank’s Mortgage Amortization Schedule Calculator for more information.

This home owner decides to refinance to a 15 year fixed rate mortgage at 2.875%. If he pays the minimum payments on his new loan his total interest will only be $58,063.75 which saves him $147,954.35!

With these low mortgage rates, now is a great time to start saving. Call a licensed loan officer today at 1-800-555-2098 and request your free rate quote.

**Mortgage Rate Disclaimer: Recent rate but rates, loan products & fees subject to change without notice. Your rate and term may vary. Fees & charges apply and may vary by mortgage product. Subject to underwriting approval. Application required; not all applicants will be approved. Important information relating specifically to your loan will be contained in the loan documents, which alone will establish your rights and obligations under the loan plan. Call for details at 1-800-555-2098.

800-555-2098

800-555-2098