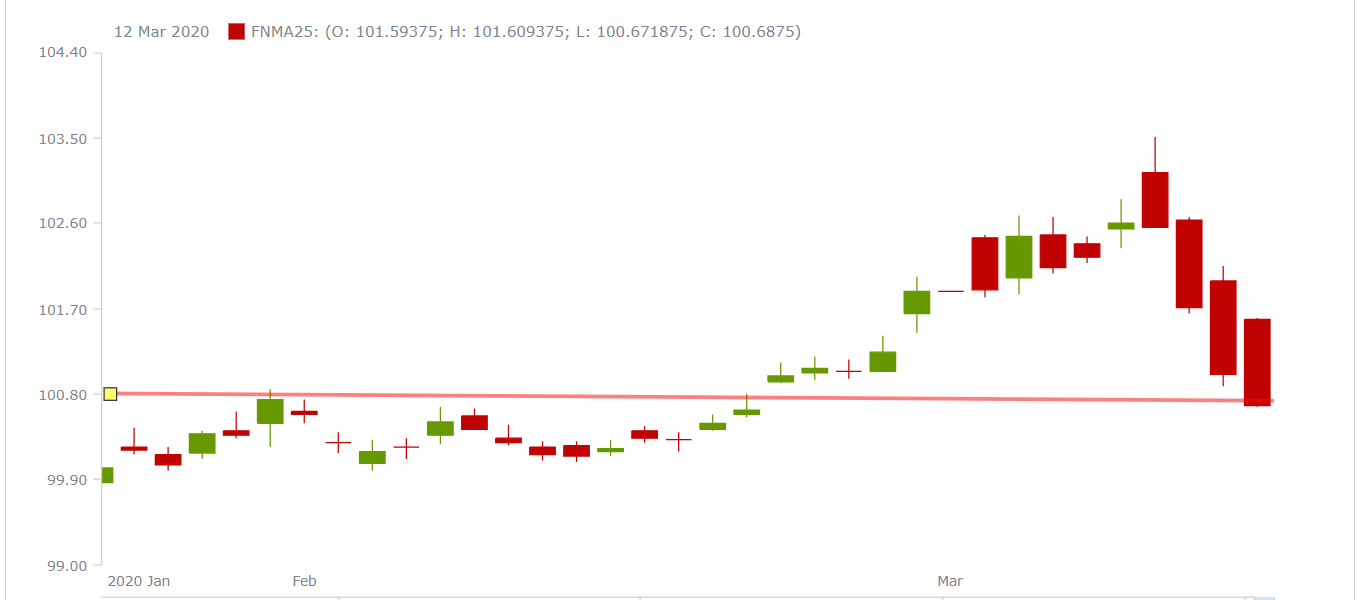

The Coronavirus has wreaked havoc on the financial markets so far in March 2020. Investors have been fleeing from stocks and investing in lower risk assets such as Bonds, Treasury Notes and Mortgage Backed Securities. This has helped us hit the lowest mortgage rates in history. The news is quick to report on the low… Read more »

800-555-2098

800-555-2098