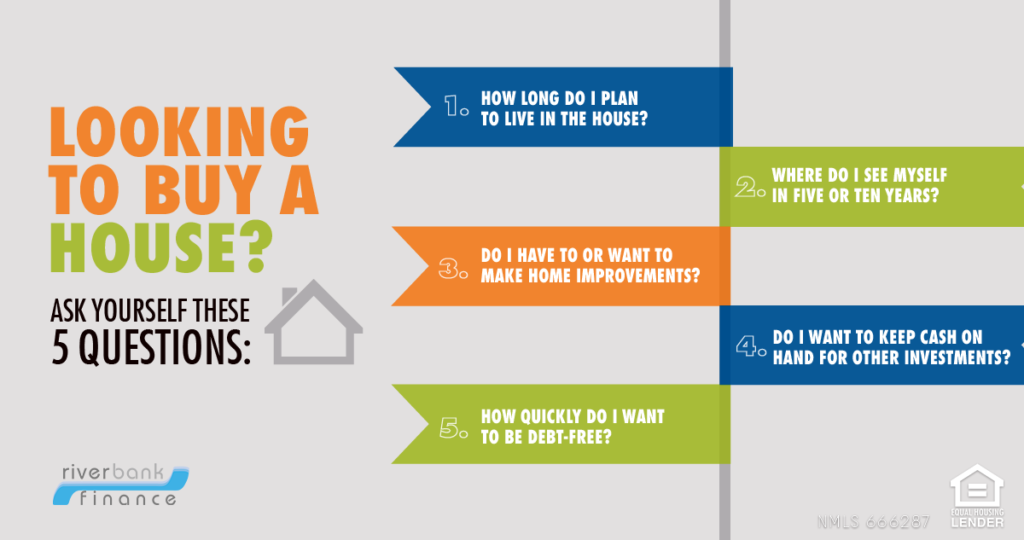

How Long Do I Plan to Live in the House?

Before you decide to buy a home you should review your goals and timelines. It is important to know how long you plan to live in your home.

Each timeline will have different goals for financing so plan this up front to save the most money with your mortgage!

Short Term Housing

If you plan on staying in a home for a very short amount of time, under a year for example, you may be better off renting. Closing costs and costs to sell a home may take away any financial benefits of owning.

The Starter Home

If you know you will be moving within 1-3 years you will want to structure your financing to get the lowest closing costs for your mortgage. Ask your loan officer about Lender Paid Closing Costs.

No Plan on Moving Soon

If you plan on living in your home between 3-5 years, getting a balanced mortgage with a low rate and low closing costs will be the best fit.

Buying the Forever Home

If you are buying your “forever home” and plan to stay in your home for at least 5 years, then getting the lowest rate should be a priority. Even if you have more costs up front, the monthly savings from having a lower rate and payment will pay off in the long term.

Do I Plan to Do Home Improvements?

When you buy a home, the first rule is Location, Location, Location. You can make any home into your dream home but you cannot change the location. Sometimes you have to sacrifice some of your needs and wants to get a home in the “Right” location.

This may mean that you need to buy a home and do home improvements after you purchase. If you know the home you are buying will need some work, it is important to budget for these repairs.

Ask yourself these key questions when it comes to home improvements:

- How do you plan to pay for the home improvements?

- How quickly will the upgrades need to be completed?

- Will you save up and pay cash or finance the repairs?

- Will you do the repairs yourself or hire it out?

If the repairs are significant, you may want to consider a Home Renovation Mortgage when you purchase which allows you to finance in repairs.

Do I Want to Keep Cash on Hand or Make a Large Down Payment

There is an old saying when it comes to money, “Cash is King!” This saying holds true when it comes to owning a home. It is important to have some cash saved up when buying a home.

There are several things to consider when it comes to using your cash when buying a home:

- Should you keep money in the bank for emergencies or home repairs?

- Should you use your cash for investments or retirement?

- Should you make a large down payment to lower your monthly mortgage payment?

These are all important things to consider when budgeting to buy a home. For some, applying a 20% down payment will help them to avoid Private Mortgage Insurance (PMI) which will result in a lower monthly payment.

For others, getting a zero down mortgage or putting down only 3% may allow them to buy the home they want and have money left over for Home Improvements or repairs.

How Quickly Do I want to be Debt Free

When buying a home, it is important to plan for the long term future. You should ask yourself how quickly you want to become debt free by paying off your mortgage.

For some, buying a home is only the start of their adult life and they need to have flexibility to have low monthly mortgage payments. A 30 Year Fixed rate mortgage may be the best fit in this scenario.

For others that are nearing retirement age, going with a shorter term mortgage, like a 15 Year Fixed Rate Mortgage may be the best fit. Typically a shorter term will have a lower interest rate and will help you to pay off your mortgage more quickly.

Home Buyer Advice

There are several things to consider when buying a home which makes it important to work with an experience mortgage professional such as a mortgage broker.

A mortgage broker will help you to review your goals and structure a loan to help you save money. They can do calculations such as a break even analysis to advise if you would be better off with a low closing cost mortgage or a low rate mortgage.

To Speak with a Licensed Michigan Mortgage Broker call Riverbank Finance today at 800-555-2098 or request information below.

800-555-2098

800-555-2098