What is TRID for Home Loans?

What is TRID for Home Loans?

The CFPB (Consumer Finance Protection Bureau) issued the TILA-RESPA Integrated Disclosure Rule (TRID) which will go into effect on 10/3/15. The purpose of TRID is to help home loan clients understand mortgage transactions by simplifying important forms and disclosures. TRID will be followed by all banks and mortgage lenders nationwide and will affect all residential real estate transactions secured with a mortgage loan excluding HELOC’s, reverse mortgages, and mobile home loans not on real property.

Related Article: New Loan Estimate Form and Closing Form for 2015

How Does TRID work?

TRID will replace the current mortgage process, timelines, and forms under RESPA and TILA regulations. While clients may not notice a change in the home buying or refinance process, mortgage loans officers, real estate agents and title agents will be required to be familiar and operate under new TRID rules.

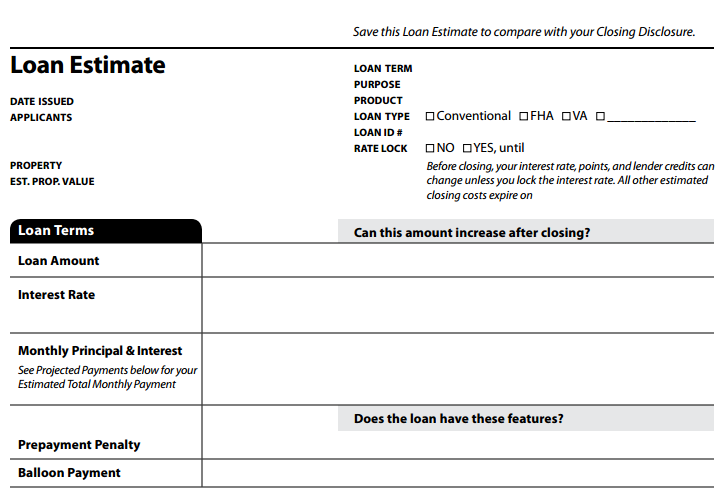

The Loan Estimate Form (LE)

The Loan Estimate Form (LE) will replace the forms currently known as the Good Faith Estimate (GFE) and Truth in Lending statement (TIL). The LE must be given to the applicant at least three business days from application and again seven business days before loan consummation (final loan closing).

TRID Loan Estimate Example Form:

Intent to Proceed Form

The intent to proceed is a form which confirms that the applicant has reviewed the Loan Estimate and intends to move forward with the mortgage application. The Intent to Proceed requires a signature from the borrower within ten business days from the LE disclosure date. If it was not signed within ten business days a Changed Circumstance must be done and a Revised Loan Estimate (LE) must be provided to proceed. The Intent to Proceed Form must be signed before fees can be collected from the client.

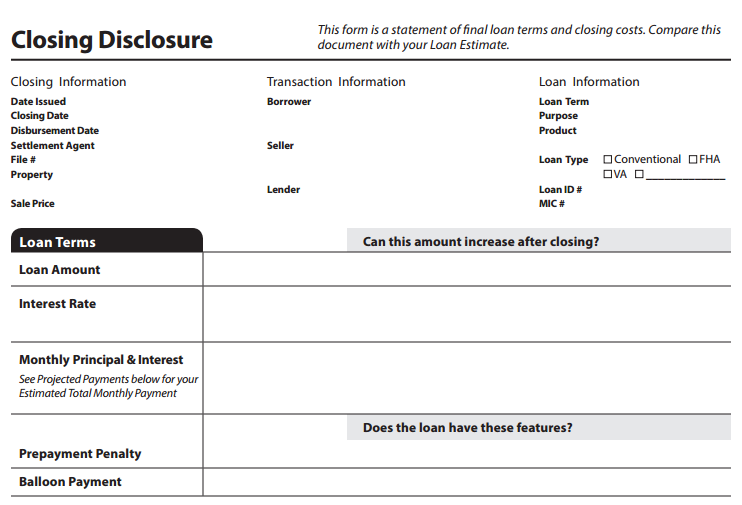

The Closing Disclosure Form (CD)

The Closing Disclosure Form (CD) will replace the final Truth in Lending statement (TIL) and HUD-1 Settlement Statement (HUD). The CD must be given to the applicant at least three business days before loan consummation if given electronically or in person; if mailed, seven days before consummation.

TRID Closing Disclosure Example Form:

What is considered a Business Day for TRID?

Disclosure waiting periods for TRID are by business days only which are defined by Monday through Saturday excluding legal public holidays. TRID business days may vary by institution if they are closed for business on additional days.

Will TRID hold up the appraisal ordering process?

According to CFPB guidance, companies may not impose any fee on a consumer in connection with their mortgage application until the consumer has received the Loan Estimate and signed their Intent to Proceed. This limitation includes imposing application fees or appraisal fees. If the appraisal fee is being charged to the client there may be a delay due to waiting periods. Collecting credit card information to charge after the form is signed is also prohibited under law.

Will TRID delay home loan closings?

With the new waiting periods for disclosure of the LE and the CD there is a potential for closing delays, however, if the lending institution plans ahead and provides these disclosures in advance, the loan process should not have any delays. Most lenders will be issuing the Closing Disclosure once all credit conditions are cleared before the underwriting clear to close. If the CD is provided at this time, the loan can close immediately after the loan is cleared for closing.

Closing delays due to TRID should not be an issue with most lenders.

Required re-disclosure of the Closing Disclosure would restart the waiting period. A new re-disclosed Closing Disclosure would be required only if the loan terms change from a fixed rate to an adjustable rate, if a pre-payment penalty is added or if the Annual Percentage Rate (APR) increases more than 1/8 of a percent for a fixed rate or 1/4 of a percent for an ARM. By the time the CD is issued, the fees should already be confirmed therefore re-disclosure requirements will not be a common problem.

Re-Disclosing the TRID Closing Disclosure will be required if:

- The loan term changes from a fixed rate to an Adjustable Rate Mortgage (ARM)

- A pre-payment penalty is added to the mortgage

- The Annual Percentage Rate (APR) increases more than .125%

For more information regarding the new TRID regulations starting October 3rd, 2015 visit the CFPB TRID guide, call a licensed loan officer at 800-555-2098 or request information below.

For more information regarding the new TRID regulations starting October 3rd, 2015 visit the CFPB TRID guide, call a licensed loan officer at 800-555-2098 or request information below.

800-555-2098

800-555-2098