The Federal Housing Administration has announced that they will be reducing the mortgage insurance premiums (sometimes called PMI or MIP) charged on all FHA loans. The rate reduction will be nearly half the current costs cutting the insurance premiums down from 1.35% to .85% annually. This is great news for new home buyers and those that currently have FHA mortgage loans.

The History of the Federal Housing Administration (FHA)

The FHA program has been in place since 1934 when it was created to help spur home ownership in the United States. At the time, banks required very large down payments and strict mortgage terms which allowed very few to qualify to become homeowners. Since then it has insured mortgage loans for over 34 million home owners and remains a major loan program to consider.

What are the benefits of FHA Loans versus Conventional Loans?

FHA loan options typically have lower down payment requirements and more flexible guidelines than conventional financing. Many clients choose FHA financing for home purchases for benefits that can include as low as a 3.5% down payment, higher debt-to-income (DTI) ratios, home renovation options, lower mortgage rates and lower minimum credit standards as compared to conventional loans.

What do Lower Mortgage Insurance Premiums mean for New Home Buyers?

With the lower mortgage insurance premiums, home buyers will be able to save on their monthly payments. This monthly savings may allow them to qualify more easily or even qualify for a more expensive house for the same mortgage payment (FHA loan example).

With today’s low inventory of homes for sale, this may allow home buyers to expand their searches to find the home they have been waiting to purchase. Additionally, the lower mortgage insurance premiums may allow them to consider renovating a property or including upgrades into their financing through programs such as the FHA 203k renovation loan. The FHA 203k Streamline Renovation Mortgage may allow a home buyer to finance up to $35,000 in repairs for things such as new appliances, carpeting, flooring, paint, electrical fixtures and other upgrades to make a home their dream home.

What does Lower FHA Mortgage Insurance Mean for People that Have Recently Gotten a FHA Loan?

Those that have recently purchased a home with FHA financing or refinanced to a FHA loan, may be eligible to take advantage of the reduced insurance costs by refinancing their mortgage. Now is a great time to refinance due to the lowest rates in nearly 2 years as well as the lowered insurances costs.

If you have paid at least 6 mortgage payments on your FHA loan you may qualify for a FHA Streamline Refinance. This FHA refinance program allows a homeowner to refinance their FHA loan to a new FHA loan with a lower rate. The FHA Streamline Refinance Mortgage typically has no costs, no application fees, no appraisal and no income documentation.

How Do I Qualify for a FHA Streamline Refinance Mortgage?

Qualifying for a FHA streamline refinance is as easy as paying your mortgage payments on time. Once you have paid a minimum of 6 mortgage payments on your FHA loan and you can save at least 5% off your mortgage payments you may be eligible for a FHA Streamline refinance loan.

How much will the Lower Mortgage Insurance Costs Really Save on a FHA loan?

To show the savings on the FHA mortgage insurance it may be best to take a look at an example FHA loan scenario. Let us make the following assumptions:

Loan Purpose: Home Purchase

Loan Type: FHA 30 Year Fixed

Purchase Price: $250,000

Down Payment: 3.5% ($8,750)

Interest Rate: 3.50%

Base Loan Amount: $241,250

Annual Property Taxes: $2,400

Annual Home Insurance: $900

| Before 1/26/2015 | After 1/26/2015 | |

| Principal & Interest | $1,102.28 | $1,102.28 |

| Property Taxes | $200.00 | $200.00 |

| Home Insurance | $75.00 | $75.00 |

| Mortgage Insurance | $271.41 | $170.89 |

| Total Mortgage Payment | $1,648.69 | $1,548.17 |

In the above illustration of reduced FHA PMI, the home buyer would save $100.52 per month on their mortgage payments. Over the life of their loan that would give them a total savings up to $36,187.20 (if they kept their loan for the full term). This is a savings of over 6% which would be the equivalent of $15,000 more purchasing power for the same payment or a home purchase price of $265,000 vs $250,000.

When do the lower FHA Mortgage Insurance Premiums start?

FHA case numbers starting Monday January 26th, 2015

The FHA will begin issuing new FHA case numbers starting Monday January 26th, 2015. From that date forward any new FHA loans started will be allowed to take advantage of the lower mortgage insurance costs.

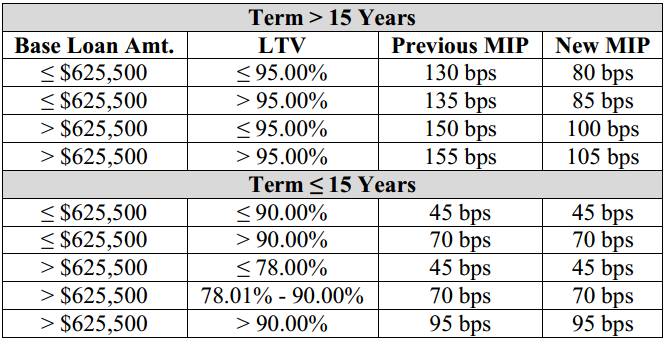

2015 FHA Mortgage Insurance Premiums Chart

What if I am currently in the process of getting a FHA loan? Can I still get the lower rates?

Yes. You may be able to get the reduced MIP if you have not yet closed and funded your loan. Speak with your loan officer about requesting a cancellation of your current FHA case number and ask them to request a new FHA case number on or after January 26th, 2015.

What is the Minimum Credit Score for FHA Loan Financing?

Each bank and lender sets their minimum required credit score for FHA financing. While most banks and lenders set the minimum credit score at 640 and up, some lender allow for credit scores much lower. For example as of 1/26/2015 Riverbank Finance LLC will allow credit scores as low as 560 with a 10% down payment and 580 with only a 3.5% down payment for FHA loans in Michigan.

How Do I Apply for a FHA Mortgage Loan?

The Federal Housing Administration does not directly lend money. They insurance banks and lenders against losses which allow them to lend with eased guidelines. Applying for a FHA loan can be done by speaking with a licensed loan officer at 800-555-2098 or click here to apply for a FHA Loan.

Where can I Find More Information the Reduced FHA MIP?

The announcement was made on January 9th, 2015 from the FHA Mortgage Letter 2015-01. For more information on FHA loans visit www.hud.gov or speak with a HUD approved counseling agency in your area.

Disclaimer: Riverbank Finance LLC is neither a government organization nor part of FHA or HUD. Rates, terms, fees, and programs given above are examples for illustration purposes only. This is not a commitment to lend. Not all will qualify.

800-555-2098

800-555-2098