All throughout school we are graded. After graduation we tend to have the mindset “YES! I passed! No more teachers, no more grades!”

All throughout school we are graded. After graduation we tend to have the mindset “YES! I passed! No more teachers, no more grades!”

However, that is not the case – not at all.

From childhood into the first few years of our adult lives we receive report cards stating how well we did on an academic grading scale. After that, we are graded based on our financial habits: our credit.

So, what is credit?

In its simplest form credit is trust.

If you don’t have good credit, you don’t trust. If you don’t have trust, you won’t have anything.

Credit gives us the ability to acquire goods and services before making an actual payment or before paying off a balance in full; we are able to borrow money or purchase items on credit. This system is all done based on an agreement, based on trust, that the balance due will be paid back in a timely fashion.

Your credit could be the deciding factor on weather you are able to become a homeowner or not.

Related: Low Credit FHA loans

Trust must be gained

Likewise, credit must be gained, it is not given. It is something you must work towards and earn.

Similar to employers needing to see your resume prior to determining if you are right for a position, lenders must look at your credit report to see if you are eligible to receive their trust – that is, to see if they allow you to take out a line of credit: a credit card, a loan, a mortgage, etc.

What is a Credit Report?

A credit report is a financial report card.

A variety of financial information is taken into account and provided in a credit report: bill payment history, loan repayment history, amount of credit, amount of debt, public records, account types (bank accounts, student loans, mortgages, etc.), bankruptcies, etc.

The information provided on your credit report is used to calculate your credit score.

What is a Credit Score?

In comparison to the academic grading system, your GPA (grade point average) is equivalent to your credit score (AKA FICO score).

Your grades are used to calculate your GPA; your credit score is calculated by the information in your credit report.

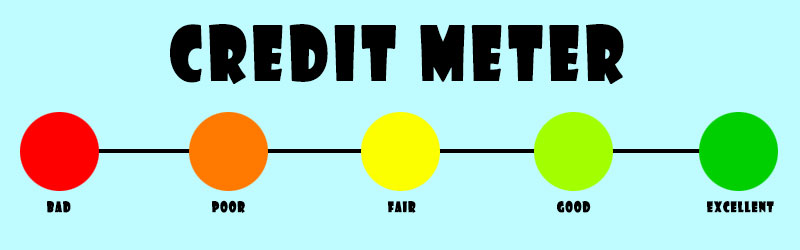

Credit scores are represented by numbers: 300 to 850:

- Excellent: 720 to 850

- Good: 680 to 719

- Average: 620 to 719

- Poor Credit: 580 to 619

- Bad Credit: 500 to 579

- Miserable Credit: 300 to 500

The higher your credit score is the better off you are. Your score affects whether you are eligible to borrow money, the amount you are eligible to borrow, the interest rates of the loan and the terms you have to abide by.

An excellent credit score of a 720 or higher means that you are a low risk borrower. In other words, a lender trusts that if they lend to you, you will make all of your payments on time throughout the life of the loan; they trust you.

On the opposite side of the spectrum, if you have a miserable credit score lenders categorize you as a high risk borrower. That is, they are much less likely to lend to you because they will not trust you enough to pay them back.

If you don’t have the best credit you may still be eligible to buy a home with bad credit by working with the loan officers at Riverbank Finance LLC.

In sum, the higher your credit score is the more opportunities you will have.

Credit Bureaus

Credit bureaus, or credit reporting agencies, gather your credit information and provide your credit reports.

There are three Credit Bureaus or Credit Reporting Agencies: Equifax, Experian and TransUnion.

It is important to know that not all of your information is reported to each of these bureaus. One may receive your credit card information, while the other two will not. Another bureau may receive your mortgage information and not the others, and so on and so forth. Therefore, each bureau may provide you with a credit report that varies from the other two.

You are entitled to a free annual credit report from each of these bureaus. You are able to request your credit report(s) at www.annualcreditreport.com (or call 1-877-322-8228).

Riverbank Finance also offer an instant credit report online that you can request for a home purchase.

Better yourself, better your credit!

If you would like your credit score to be higher than what it is you may want to make some lifestyle changes.

Some key pints to live by:

- Pay your bills, and pay them on time!

- If you do miss a payment pay it ASAP! Try your hardest to stay current on your bills.

- Pay off your debt, don’t add onto it.

- Keep your credit balances low. Maxing out your credit cards month after month make it seem like you are irresponsible.

- Do not open unneeded credit accounts. According to Credit Karma having four to six credit cards open is a healthy if you manage them currently – it will make your look responsible!

- Check your credit report and make corrections when needed.

- Do not be afraid to get help! If you are concerned or unsure of what to do when it comes to your credit ask a professional.

800-555-2098

800-555-2098